Co-authored by Robin Boyd and Ashley Caudle | SC&H Group Investment Funds Tax Team

Updated 5/27/2021

As an investor, the thoughtful planning and management of your investment portfolio can surface tax incentives that might otherwise be overlooked. With the guidance of a professional tax advisor, you can gain an in-depth, unambiguous understanding of the tax consequences of investments in specific funds, therefore optimizing your portfolio and maximizing your results. The following is a deep dive into the potential advantages you can obtain for your investment funds through Section 1202.

What is Section 1202 and How Does Someone Qualify?

Section 1202 allows non-corporate taxpayers to exclude all or part of a gain when qualified small business stock (QSBS) is sold. The potential savings here are significant so it’s important to consider this when structuring transactions.

To qualify as QSBS under §1202, the following requirements must be met:

- The stock must be in a domestic C Corporation.

- The stock must be acquired by the taxpayer at original issue in exchange for money, other property (not including stock), or as compensation for services provided to the corporation.

- The corporation must have gross assets under $50 million as of the date the stock was issued and immediately after. These assets are valued at original cost instead of fair market value, except for contributed property.

- The corporation must conduct an “active business” rather than be an investment company during the entire holding period of the taxpayer’s stock. At least 80% of the assets must be used in the active business.

What are the Tax Benefits of Section 1202?

If you have held stock that meet the qualifications above for at least five years, you may be able to exclude a portion or all of your gain for federal tax purposes. The remaining capital gain is taxed at 28% (assuming you are in the 15% or 20% brackets for regular long-term capital gains). The gain exclusion is limited to $10 million or ten times the adjusted basis in the stock*.

- *Note – The $10 million exclusion is one-time only. A taxpayer cannot exclude $10 million in year 1 for selling part of the stock and then exclude an additional $10 million in year 2 for an additional sale of stock in the same QSBS.

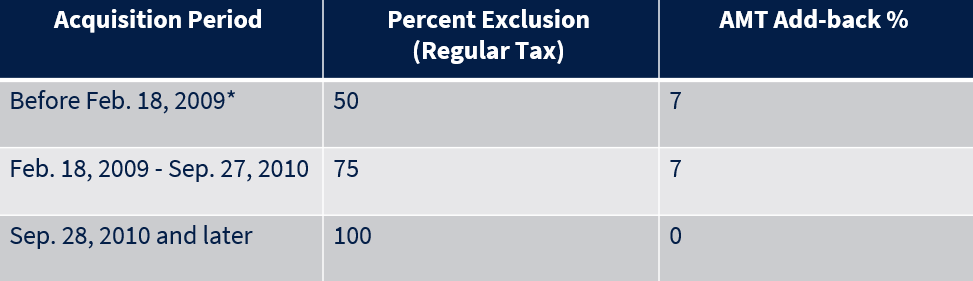

Depending on when you first acquired the QSBS, the exclusion percentages vary. As time has passed, the exclusion percentage has increased because Congress wanted to encourage investment in small businesses. With the passage of the Protecting Americans from Tax Hikes (PATH) Act in 2015, the 100% exclusion window was made permanent, which is great news for those investing in small businesses. The table below shows the federal exclusions for regular and alternative minimum tax (AMT) purposes.

Federal Exclusion of Gain:

*If the acquisition occurred before January 1, 2000, AMT add back is 42%.

Please note that some states follow the federal tax treatment for sale of QSBS while others have different rules. This is often overlooked when structuring transactions. The net investment income tax does not apply to the gain excluded from capital gains tax under §1202.

Planning Considerations:

If you have stock that qualifies as QSBS, keep good records so that you can claim your QSBS benefits. If you think you are buying stock that may eventually qualify for QSBS treatment, ask the company to certify that it meets those qualifications now.

It is vital that you know when your investment reaches the five-year holding period. You don’t want to sell too early and miss out on potential benefits.

Want to Capitalize on Additional Tax Planning Opportunities?

Additional information regarding QSBS can be found in the other articles as part of our investing insights series: