Authored by Andy Spencer, CIA | Senior Manager, Contract Compliance Audit

Businesses across the globe are grappling with historic rates of inflation. In 2022, the U.S. annual average inflation hit an all-time high of 8%, while the global inflation rate topped out at 8.73%. Rising costs for raw materials, labor, and third-party services throughout the supply chain put businesses at increased risk of margin erosion and contract non-compliance. Responsible for the majority of an organization’s external spend, procurement is tasked with finding effective ways to offset inflationary cost pressures.

Though some believe inflation is forecasted to slow in 2024, procurement leaders shouldn’t relax yet. Recent studies show that significant supply chain disruptions, including pandemics, cyber-attacks, and geopolitical conflicts happen every 3.7 years on average. Supply chain disruptions are a direct cause of inflation, and as much as 45 percent of one year’s earnings could be lost each decade because of these disruptions. This puts procurement under additional pressure to build a cost-effective, risk-averse supplier network.

Procurement Needs to Think Beyond Traditional Methods

Decreasing margins naturally incentivizes organizations to find effective cost-saving strategies. Traditional levers that procurement often pull may be insufficient to offset costs or potentially create risks, such as:

- Negotiating price reductions: Procurement can attempt to negotiate price reductions with suppliers, but only so much downward pressure can be applied to suppliers who are experiencing the same inflationary environment.

- Outsourcing and subcontracting: Suppliers facing their own inflation pressure may look to undisclosed outsourcing or subcontracting to reduce costs, but this poses significant risks that can affect work quality, contract compliance, co-employment risk, and data security.

Procurement must look deeper into its processes and suppliers to uncover strategies that can unlock value while mitigating risks, preserving margins, and ensuring good governance. These four proven methods can help procurement professionals meet their goals while alleviating the many pressures of inflation.

1. Align Procurement Initiatives With Business Goals

Procurement must understand the operational needs and financial demands of the business to build a sourcing strategy that aligns with business goals. Finding solutions that satisfy the requirements of all stakeholders is a challenging process that requires close collaboration between procurement and executive leadership. By acting as an internal partner, rather than a contracting mechanism, procurement can help build, evaluate, and optimize relationships with key suppliers. Properly leveraging relationships with mutual accommodations will drive successful outcomes through cost reductions and efficiency gains.

2. Optimize Supplier Relationships to Achieve Mutually Beneficial Outcomes

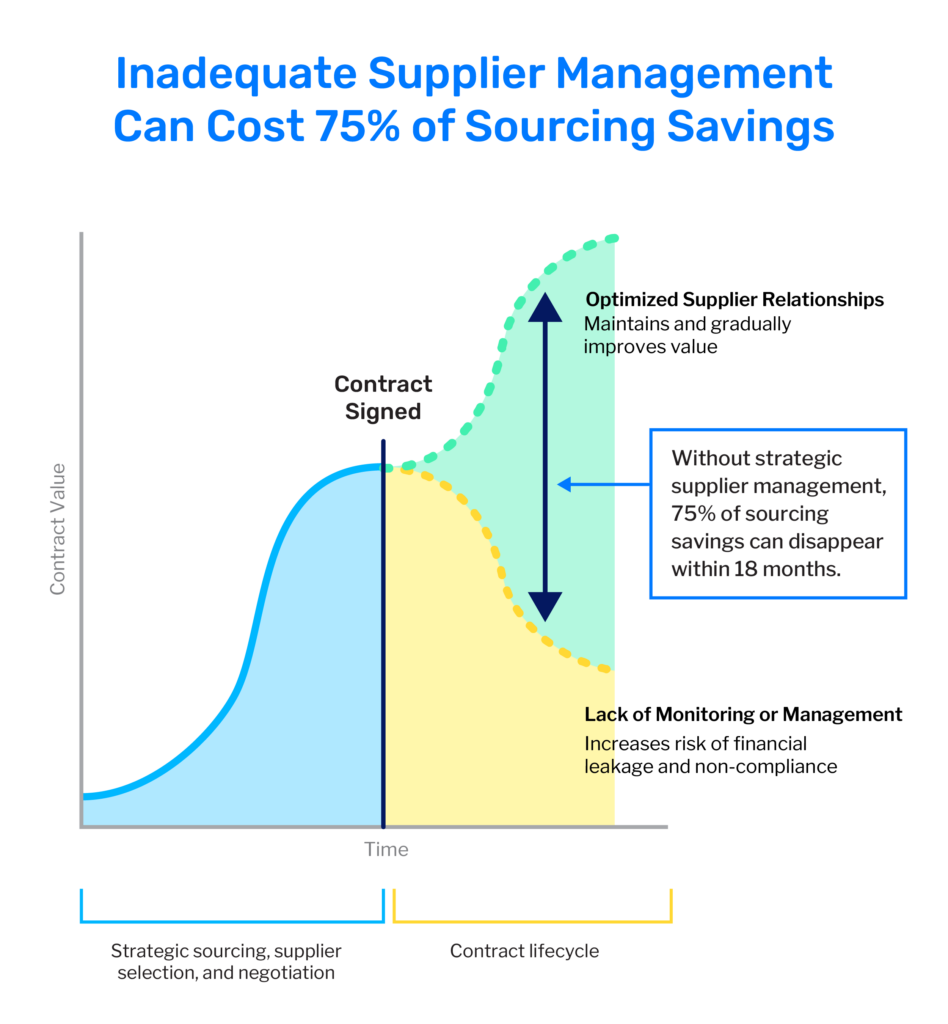

Procurement can collaborate with business owners and suppliers to identify mutually beneficial strategies to achieve common objectives, irrespective of the economic environment. As shown in the graph below, when supplier relationships aren’t properly managed and optimized, cost savings can disappear quickly.

A few methods to optimize supplier relationships while preventing margin erosion include:

- Consolidating expenses across various spend categories with fewer suppliers. This will increase buying power and identify cost savings opportunities. Trading margin for sales is a fair deal most suppliers will readily accept.

- Alerting business owners and invoice approvers to look out for supplier surcharges, new charges, and uplifts. Many contracts default to shift the risk of rising costs to suppliers, so it’s worth reviewing your contract clauses to see if your organization is protected against various cost increases.

- Reporting reduced service levels and suboptimal deliverables. Sudden changes can indicate that a deeper analysis of the supplier relationship is required. Most supplier partners won’t try to substitute lower-cost goods or services, but that can occur, and awareness is key to proactively mitigating risk.

- Separating real cost increases from attempts to enhance margins. Raw material costs and labor often have published indexes that serve as benchmarks to verify price increases. However, negotiable costs such as overhead and profit can mask overcharges and require closer review to ensure compliance.

3. Ensure Contracts Have Language That Protects the Company From Inflation

To reduce the risk of financial leakage during inflation, it is important to include language in contracts that safeguards the company from unauthorized charges, price increases, and other exposures. We often recommend the following contract clauses:

- Pricing escalation clause: Require properly signed contract amendments for all price increases as a control mechanism for adjusting costs. A low threshold for changes will protect the company from unauthorized and recurring price increases without adequate business justification.

- Audit clause: Enable parties to review billing details to ensure compliance with contractual terms including pricing, rebates, third-party costs, and use of subcontractors. The right to audit is key to promoting supplier transparency, validating negotiated savings, identifying gaps or discrepancies, and recovering overcharges that drop to the bottom line.

4. Conduct Periodic Contract Compliance Audits to Mitigate Risk

Contract compliance audits are an important tool to ensure the company realizes the full benefit of existing contract terms and that both internal and supplier business processes operate as intended.

An effective audit program can:

- Protect earnings without disrupting operations. Contract compliance audits can uncover overpayments or under-reported revenue, unrecorded liabilities, and missed savings to increase cash flow and prevent margin erosion. When performed by an experienced third-party auditor, these benefits can be fully realized without disrupting organizational or supplier operations. Effective auditors will generally require an average of 12 hours of company stakeholder support per audit.

- Leverage trust and transparency within supplier relationships for long-term value generation. Contrary to popular belief, contract compliance audits build better relationships through increased transparency and earned trust. Insights garnered from the audit can be applied to future business between the parties to generate additional value and achieve desired outcomes.

- Improve governance and prevent future errors. A third-party contract audit can provide practical recommendations and prevent future non-compliance by focusing on supplier management processes, strengthening contract language, and enhancing internal controls.

- Deter non-compliance throughout the contract management lifecycle. Periodic audits provide a unique opportunity to obtain accounting records, compare information, and validate contract compliance throughout the supplier/customer relationship. Incorporating this best practice into your business culture incentivizes supplier and stakeholder adherence to existing contract terms.

In today’s challenging landscape of inflationary cost pressures and unpredictable supply chain disruptions, procurement leaders must find creative ways to unlock value, generate savings, and mitigate risks.

Ready to engage an expert partner that can help protect earnings and offset rising costs? Our Contract Compliance Audit team can identify savings opportunities, enhance transparency with suppliers, and optimize your return on investment. Connect with our team to learn more about how we can help your organization prevent margin erosion and build long-term success.

Read next: Contract Compliance Audit Guide