Authored by Lindsay Baublitz | Principal, SC&H Capital

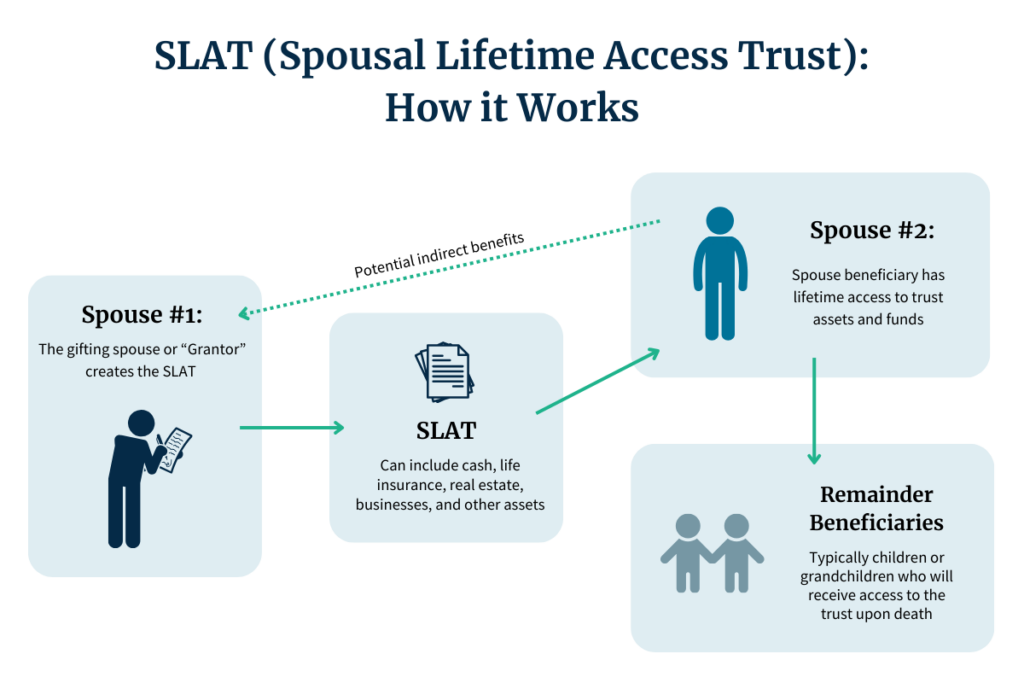

As the historically high federal estate tax exemption faces potential reduction, Spousal Lifetime Access Trusts (SLATs) are gaining more attention and popularity. A SLAT is a legal arrangement designed to help individuals transfer their assets out of their estate while providing spousal access. This can be particularly valuable for high-net-worth couples looking to reduce estate tax liabilities. In this article, we’re breaking down how they work and comparing the advantages and risks of these trusts.

Key Benefits of SLATs and How They Work

When you establish a SLAT for your spouse’s benefit, you can gift assets up to your lifetime gift exemption—currently $12.92 million per individual—without incurring federal estate taxes. Transferring these assets out of your direct ownership enables your spouse and beneficiaries to benefit from future appreciation and income tax-free.

For example: John creates a SLAT to reduce potential estate taxes and provide financial security for his spouse, Jane. He transfers $10 million of his assets into the irrevocable trust, which removes them from his taxable estate. Jane is the primary beneficiary and can access the trust’s assets if needed during her lifetime. When Jane passes, the assets will flow to her beneficiaries tax-free. By leveraging his gift tax exemption, John’s family achieves tax savings and asset protection for the transferred assets. The trust is administered by a chosen trustee, and John retains some control over its terms. This strategy efficiently transfers wealth while maintaining financial security.

This estate planning strategy offers significant advantages to the grantor and their family, including:

- Reduction of your taxable estate: Assets placed in the trust are removed from your estate, strategically minimizing estate tax liability when the assets flow from your spouse to their beneficiaries (typically your children and grandchildren).

- Lifetime access for your spouse: SLATs ensure that your spouse can directly access and benefit from the assets if needed during their lifetime. The trust can be structured to provide a regular income stream to your spouse and, in the future, allow for the distribution of assets to children or other intended beneficiaries.

- Flexibility in naming trustees: While you cannot be a beneficiary of the SLAT, you have the ability to remove and replace the trustee with another independent trustee as you see fit.

- Indirect access to funds: While you cannot withdraw assets from your own SLAT, you can indirectly benefit from your spouse’s access to trust assets for their financial needs.

Potential Drawbacks of a SLAT

While SLATs provide many benefits, they are not for everyone. There are several potential risks and drawbacks of using SLATs:

- Lack of control: As the gifting spouse, you must give up all direct control over and access to the trust assets, which can be a tough pill to swallow. Since you cannot be a trustee, you won’t have any say in whether and when distributions will be made to the beneficiaries. Many couples who consider SLAT planning ultimately decide they are not comfortable losing this much control over their assets.

- Divorce can disrupt SLAT benefits: Unfortunately, relationships change, and marriages sometimes end up in divorce. If you get a divorce, you will lose the indirect access to the SLAT funds you had through your spouse and your ex-spouse will continue to benefit from the trust. This risk can be alleviated by including provisions in the trust documents that terminate the ex-spouse’s interest or limit trust beneficiaries to the current spouse.

- Loss of access if your spouse passes: All this tax planning aims at minimizing taxes upon your death, but what if your spouse dies before you? Upon the non-donor spouse’s death, you will lose indirect access to the SLAT. The trust can either terminate and distribute existing funds to your children and other family members, or continue for their benefit. Your attorney can include provisions allowing your spouse to redirect funds to you upon their passing.

Based on these risks, it’s critical for a couple to consider how the current dynamics of their marriage might change over time and plan accordingly with an experienced attorney.

Tax Implications of SLATs

The complex nature of SLATs comes with complex tax considerations that should be carefully assessed by a tax planning professional to understand the tax impact on you and your family.

- Estate and Gift Tax Exemptions: With the current estate, gift, and generation skipping transfer tax (GST) exemption at a historical all-time high, it’s wise to maximize its use before potential changes in 2025. Irrevocable trusts protect completed gifts and future appreciation from future estate and gift taxes, and the U.S. Treasury Department and IRS have confirmed that there won’t be a gift tax due (clawback) if the exemption decreases later. You will need to file a gift tax return to report gifts in excess of the annual exclusion.

- Annual Income Taxes: SLATs are treated as separate legal entities for ownership, but not for income taxes. They are typically structured as a grantor trust, meaning that the gifting spouse, not the trust, pays income taxes generated by the trust assets annually (i.e., dividends, interest, and capital gains). Gifting spouses should ensure they can comfortably cover this tax obligation. While paying taxes is never fun, paying the tax on the SLAT’s income each year allows the SLAT to grow income tax-free over time.

- Capital Gains Tax: Gifted assets in a SLAT do not get a step-up in cost basis at the donor’s death, so any future appreciation may be subject to capital gains taxes. Beneficiaries should consider potential tax implications if they intend to sell transferred assets, although historically, capital gains tax rates have been lower than estate tax rates. More significantly, estate tax planning strategies can defer or avoid capital gains taxes, whereas death and its resulting taxes are ultimately unavoidable.

The Importance of Accurate Valuations in SLATs

To transfer assets such as cash, business interests, or real estate into a SLAT, you can either gift them or sell them in exchange for a promissory note. With either option, the assets must be transferred at their fair market value. Contributed business interests require a valuation to determine the fair market value.

Due to the maximization of lifetime gift exemptions in recent years, the IRS has begun closely scrutinizing large transfers and questioning fair market values. Therefore, it’s crucial that a valuation is completed by a qualified, independent appraiser and in accordance with all valuation standards. If the IRS questions the concluded fair market value and the dispute ends up going to tax court, the appraisal must be well-supported and follow commonly accepted valuation methodologies.

Setting up a SLAT can be a powerful estate planning tool, providing both financial security for your spouse and effective wealth transfer strategies for your beneficiaries. However, the process can be complex to attempt without expert support. Assembling a team of experienced professionals, including attorneys, financial advisors, and experienced appraisers, will ensure that your SLAT is well-structured, complies with regulations, and aligns with your unique goals. Early planning and a well-executed strategy can help you make the most of this valuable estate planning option.