Authored by Tom Hood | Principal, Finance Modernization

The role of finance is evolving in this fast-moving digital era. Today’s finance function needs new skill sets to succeed in increasingly complex and demanding environments. No longer confined to assembling data, finance leaders and CFOs have the opportunity to transform into strategic partners that shape the future through influential, data-driven decisions.

Powerful advancements in technology and automation are the catalysts of this transformation, enabling finance teams to focus on creating value and driving revenue. Research backed by our AICPA-CIMA partners shows that a successful finance transformation hinges on a few key strategies. We’re breaking down how finance leaders can make this shift from informers to impactors in today’s digital landscape.

The Four Foundational Activities of the Finance Function

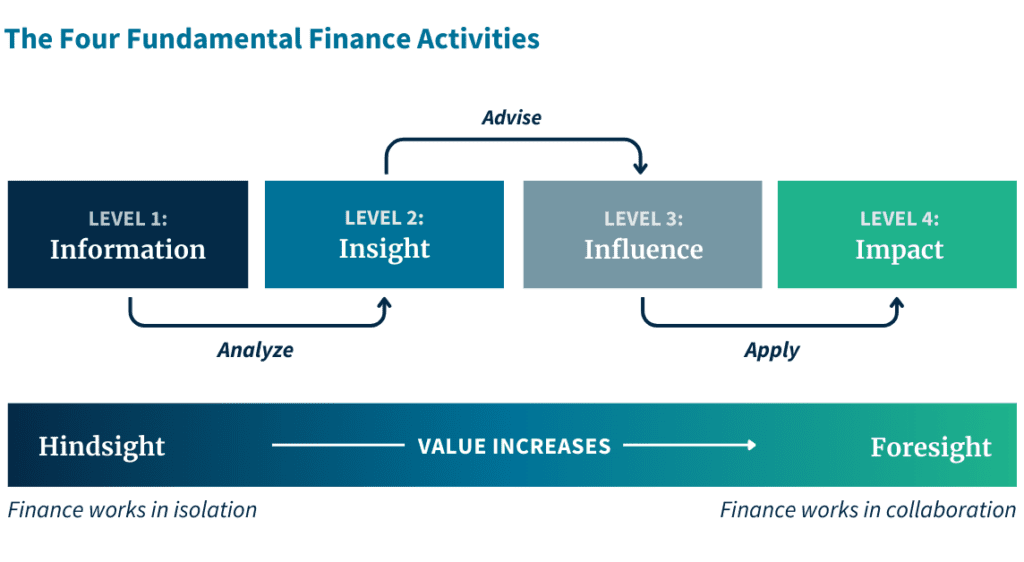

The finance function encompasses four fundamental activities, each playing an essential role in your organization’s financial progression. As you move from left to right, the level of value you’re creating increases, shifting from looking backwards (analyzing data in hindsight) to driving the future of your organization (planning and strategy in foresight).

- Level 1: Information – Cleaning, compiling, extracting, and assembling the relevant data needed to support the remaining activities.

- Level 2: Insight – Making sense of the information collected and relating it to an objective (e.g., sales are down because of x).

- Level 3: Influence – Influencing decisions as a strategic partner in the organization and ensuring those decisions are being effectively executed. This leverages the insights and acts on them.

- Level 4: Impact – Strategic leadership within the organization, using influence to make decisions and guiding the organization to where it needs to go.

Making the Shift from Information to Impact

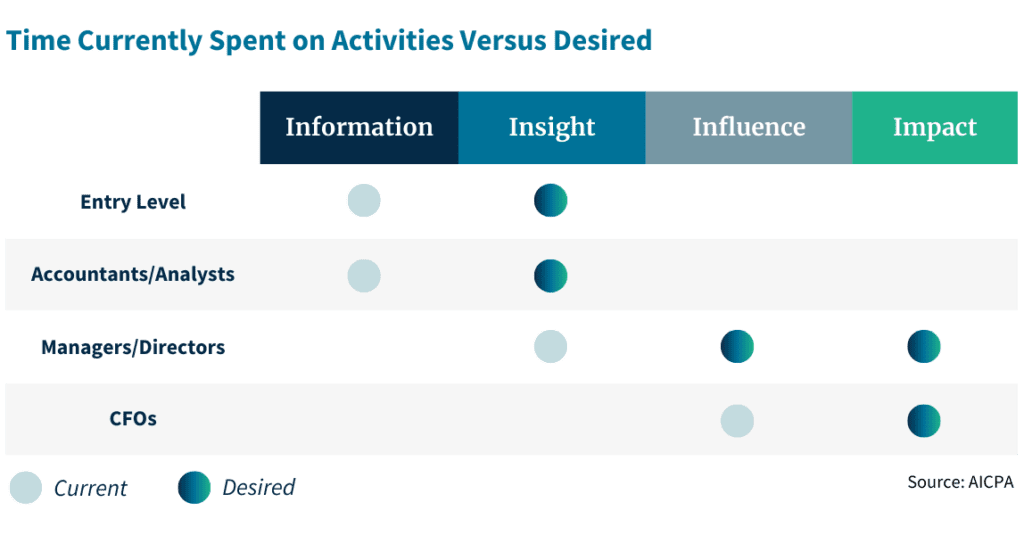

According to a recent Gartner survey, only 20% of CFOs are personally effective, meaning they deliver on short-term financial performance and promote behaviors for long-term profitable growth. Many financial leaders often find themselves trapped in the Information and Insight activities, wishing to spend more time on Influence and Impact activities. Daily pressures tend to keep them mired in the past, focusing on what happened in hindsight rather than planning for the future.

To address this challenge, technology adoption and upskilling are crucial. These measures enable finance teams to shift their focus towards the impactful activities they desire and that should be prioritized. The roadmap below demonstrates how to leverage technology and upskilling at each stage of your finance transformation.

Establishing A Clear Vision

A well-crafted vision and strategic finance transformation roadmap, both clearly aligned with company goals, are the keys to success and sustainability. They serve as the guiding force for the process, fostering enterprise-wide alignment and buy-in. A modern finance function assessment can lay the foundation for your organization’s future state vision. This will help your team:

- Reexamine the existing strategy or define a new strategy to establish your organization’s future state vision

- Identify technology gaps and skillset requirements to achieve the future state vision

- Gain buy-in at all levels to begin a crucial mindset shift that gets people excited to learn and transform

- Create ideal short- and mid-term objectives based on the vision and current-state assessment

- Establish an actionable roadmap to realize the envisioned state of your finance organization aligned with business objectives

Partnering with an experienced team like SC&H, fluent in both technology and transformation, can help you leverage the insights from your assessment to create an actionable roadmap.

Transform Your Finance Function

The experienced guidance you need build a transformation engine aligned with business strategy and emerging trends.

Explore the Engagement ProcessPowering Digital Transformation with Technology

While technology is the engine behind the digital finance transformation, recent studies show that only 37% of finance leaders have a clearly defined, company-wide technology investment strategy. Without a strategy in place, finance teams risk falling behind in a fast-evolving tech-driven landscape.

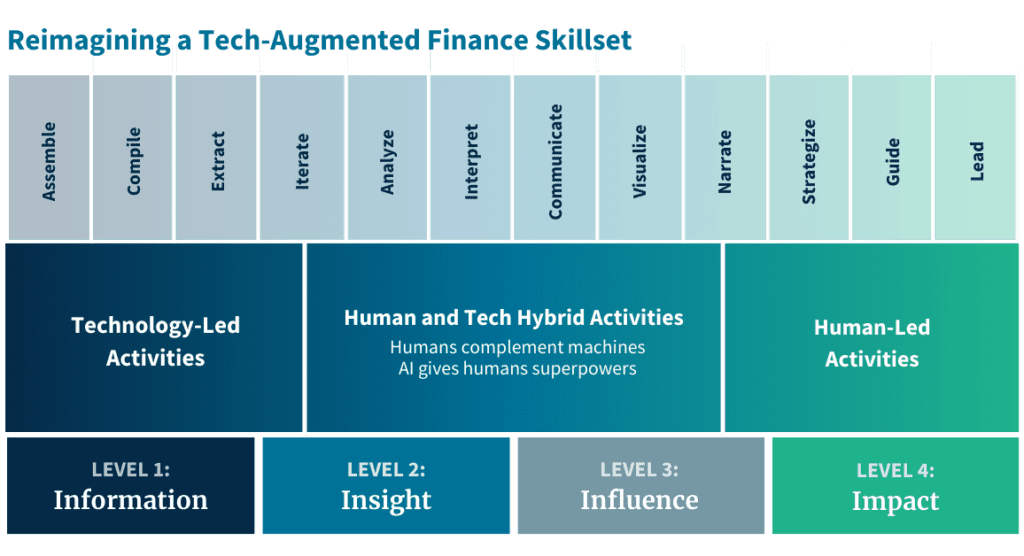

Technology needs to be heavily leveraged to automate processes, augment your employees’ abilities, and stay competitive and agile in a digital world. Tedious and repetitive tasks that once took up hours of the workday will be automated by new advancements in AI and advanced analytics. For example:

- Robotic Process Automation (RPA) can streamline and automate tasks at the Information level

- Machine learning can augment capabilities at the Insight level

- Prediction tools can enable strategic planning at the Influence level

As a finance leader, this frees up your time to be spent on high-value, high-impact activities and ultimately accelerates the shift from informer to impactor.

While machines excel at generating data and analytics, the true value emerges when leaders add context and human narratives to these data sets. As technology evolves and gets smarter, finance leaders must continuously develop the skills to leverage AI in new ways. This presents an opportunity for upskilling the finance function to become a critical piece in driving a strategic, data-driven future for the organization.

Upskilling the Finance Function and Changing Mindsets to Drive Growth

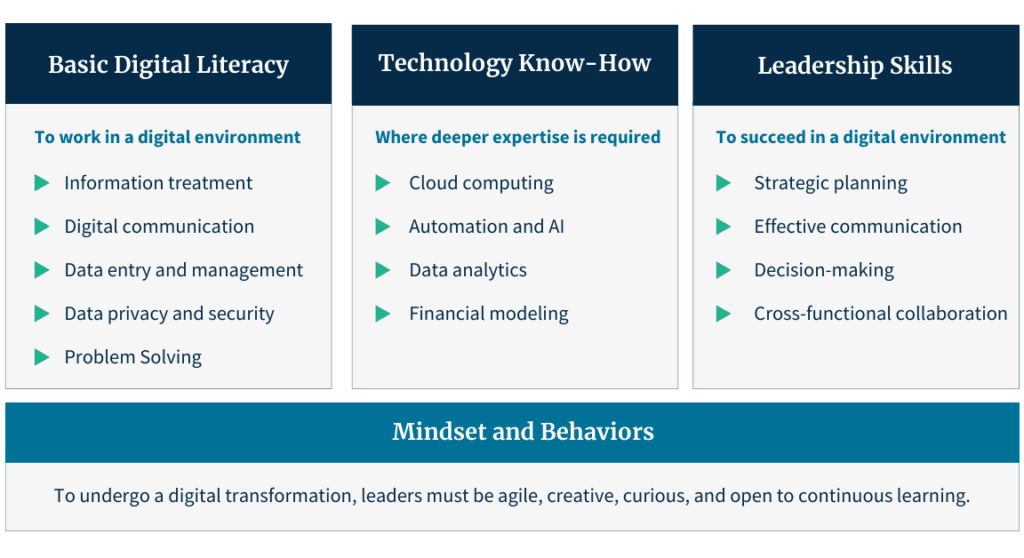

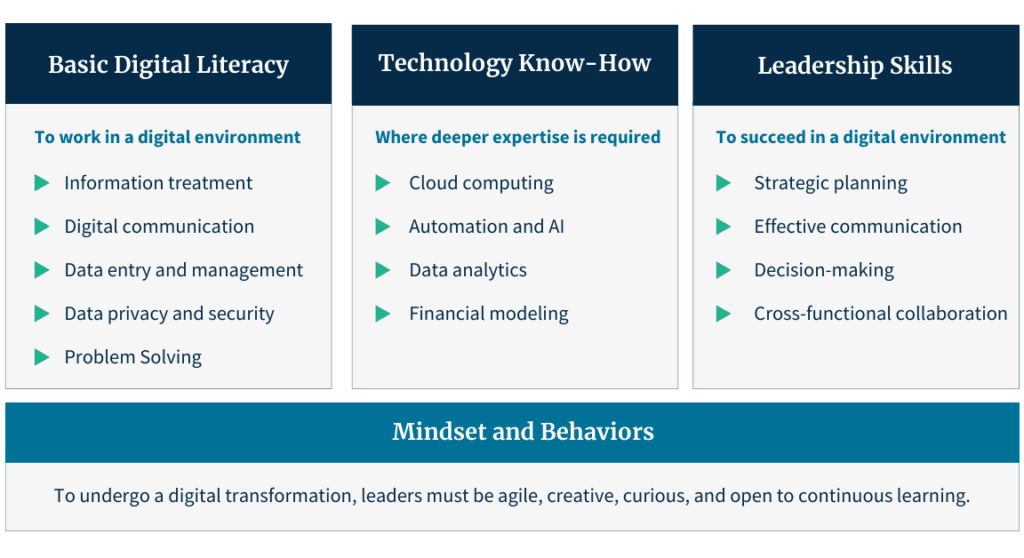

The shift from informer to impactor is likely to speed up as technology automates process-driven tasks and the finance function moves from working in isolation to working with others in the organization. This demands new technical competencies alongside essential business and people skills. Below, we’ve broken these down into three key categories: basic digital literacy, technological proficiency, and leadership skills.

The final—and most crucial—pieces in the upskilling puzzle are mindset and behaviors. In a recent AICPA study, finance leaders noted the motivation to embrace change and establish a growth mindset is the most critical factor for success in finance transformation. Fostering adaptability and open-mindedness to change with your team will be key in a fast-moving digital landscape.

Next Steps: The Modern Finance Function with SC&H

In the dynamic world of modern finance, staying ahead requires a fresh and strategic approach. This can be challenging for finance teams stretched thin across time and resources – but SC&H can help.

Developed through our financial and technical expertise and backed by AICPA research, The Modern Finance Function is a cutting-edge program that works in collaboration with your team to assess your current state, co-create your future vision, and build an actionable roadmap to lead the transformation. Gain the knowledge and insights needed to future-proof your organization with SC&H’s tech ecosystem designed for data-driven finance teams.

If you’re ready, we’re ready. Contact us today to take the first step towards finance modernization.