Authored by Judy Brown, MBA, CPA, CFP® | Principal, SC&H Financial Advisors, Inc.

If you are nearing the age of retirement, you have probably started to think a great deal more about Social Security and Medicare. While there are plenty of voices online, in your mailbox, and possibly even directly dialing you to offer help with your financial future, you should turn to someone you can trust for advice. The process of evaluating your options for Social Security and Medicare is personal, so it is important to understand your choices so that you can make an informed decision that is right for you.

The Difference Between Social Security and Medicare

Both Social Security and Medicare are plans designed to help citizens as they age. Generally, Social Security provides monthly income benefits for individuals beginning as early as age 62, and Medicare provides financial assistance with medical expenses for those 65 and older. These government-run programs also have unique benefits for disability, family, and survivor benefits; however, the focus of this article is traditional retirement planning.

Social Security Retirement Planning

Social Security offers a pension-like monthly benefit amount to citizens based on the amount of money they have paid into the program over a 35-year work history of paying taxes. Social Security requires that they must have worked and contributed Social Security taxes through payroll deductions, or by paying self-employment tax, for at least 40 credits, usually ten years.

Age to qualify: 62 is the minimum retirement age to begin collecting Social Security, though your benefits will be reduced if you collect before your full retirement age, which is determined by your birth year. If you delay collecting, your benefits will increase until you reach age 70. After age 70, Social Security does not provide a benefit for delayed filing. Deciding what age to file is a lifetime decision.

Planning Considerations for Social Security:

- Given your cash flow needs, health, family longevity, and survivor needs, what is an appropriate age to begin benefits? About one out of every three 65-year olds today will live until at least age 90, so delayed filing for Social Security could provide long term financial benefits.

- Are you aware of all of the Social Security filing strategies that are available to you? A married couple with spousal benefits has over 9,000 different month-of-age claiming combinations! There are financial programs to determine the benefits of every filing strategy for you.

- Are you still working? If you file for benefits before full retirement age and earn over $19,560 in 2022, your Social Security benefits will be reduced. Or maybe you are not working now, but plan to work before you reach full retirement age? This is an important planning consideration.

- What is the tax impact of filing for Social Security? Many people don’t know that Social Security benefits are taxed up to 85% of the benefit.

Medicare Retirement Planning

While you don’t receive monthly payments from Medicare, the financial burden of increasing medical costs is partially offset through its health insurance coverage.

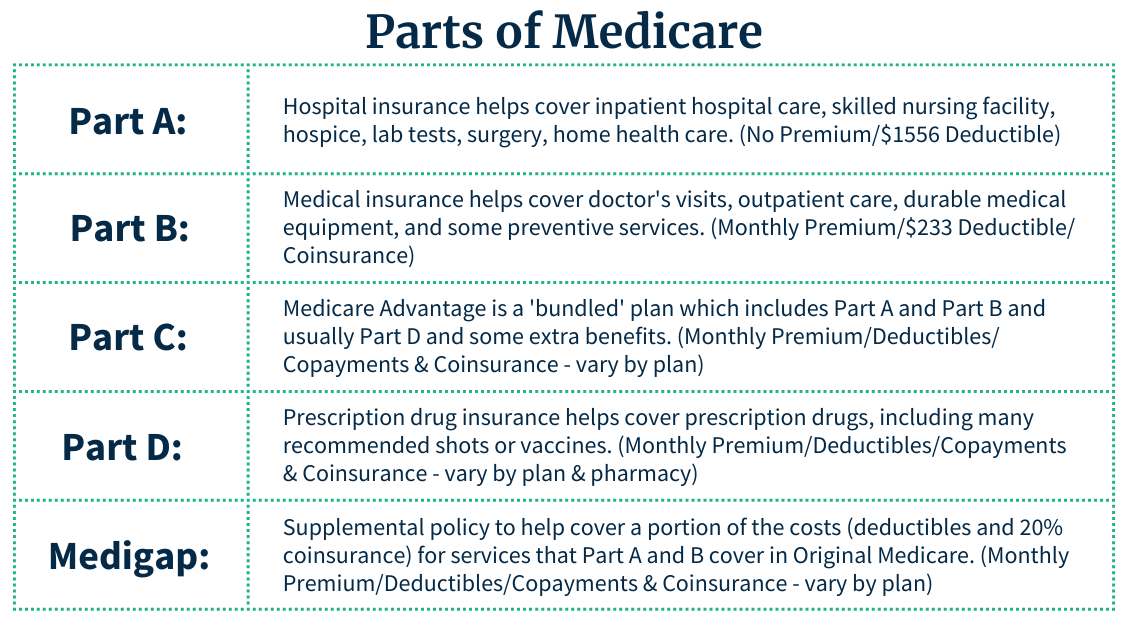

There are 2 main ways to secure your individual Medicare coverage (not including Medicaid):

- ‘Original’ Medicare which is an ‘a la cart’ approach to enrolling in Medicare Parts A, B, and usually D, along with a Medigap/Supplemental or retiree plan.

- Medicare Advantage (MA) or a ‘bundled’ approach also known as Part C.

Age to qualify: 65 (Be a U.S. citizen or permanent resident with at least five years and one month of residence in the U.S.)

Medicare Planning Considerations for Someone Nearing Age 65:

- Determine your ‘Initial Enrollment Period’ and decide whether or not to enroll in Part A and Part B when you turn 65. Examples of considerations for enrolling at 65 could include whether you are still working and have qualified healthcare, if your spouse is working and has a qualified healthcare plan available to you, if you are on retiree benefits, or if you are contributing to an HSA and have healthcare.

- Evaluate whether Original Medicare or Medicare Advantage is better for you given your cash flow, doctor preferences, prescriptions, travel, etc.

- Understand how receiving Social Security before age 65 impacts your Medicare enrollment process.

- Are you eligible for any retiree health care benefits? How do these benefits integrate with Medicare?

If you decide to delay enrolling in Medicare at 65, develop an enrollment timeline allowing at least 6 months to transition to Medicare in the future to avoid late enrollment penalties for Part B and Part D, and to avoid gaps in medical coverage.

Understanding Income-Related Monthly Adjustment Amount (IRMAA)

IRMAA was first enacted in 2003, however it was expanded in 2011 under the Affordable Care Act. IRMAA is a monthly premium adjustment to Medicare Part B and D based on an individual’s modified adjusted gross income (MAGI). There is a two-year look back, so 2022 IRMAA premiums are based on a person’s 2020 MAGI.

There are various tax planning strategies to manage a person’s MAGI and IRMAA. Another possible way to reduce IRMAA is to file an IRMAA exception. If you have had a life-changing event in the last 2 years, such as retirement, divorce, death of a spouse, etc. you may be able to reduce or eliminate IRMAA. Your financial advisor can help you evaluate this option.

Plan Your Retirement Today

Understanding Social Security and Medicare is very complicated. However, it is an important part of many people’s financial success in retirement. By carefully building a financial plan which incorporates Social Security and Medicare strategies, many people can feel secure with their cash flow and healthcare so that they can enjoy their retirement years.

At SC&H Financial Advisors, our CPAs and financial advisors have a long history of helping people arrange their finances as responsibly as possible post-retirement. With the right financial advice, you can learn how to manage your money now to optimize your Social Security benefits later. Reach out to an experienced helping hand of one of our professionals at SC&H Financial Advisors. We can help you navigate the often-confusing waters of retirement planning no matter what stage of life you’re in.