& Sarah Reeves | Senior Tax Manager

To address budget deficits, the Maryland General Assembly recently passed a range of tax increases impacting both businesses and individuals. Among the most notable changes are:

- A new 3% sales tax on certain information technology and data services

- Higher personal income taxes for top earners

- Increases in various fees and excise taxes

Here’s a breakdown of what changed and how it may impact you.

New 3% Sales Tax on Data and IT Services

Beginning July 1, 2025, a 3% sales tax will apply to IT and data services (i.e. “tech tax”). This applies to services, including:

- System software or application software publishing services (NAICS Code 5132)

- Computing infrastructure providers, data processing, web hosting, and similar services (NAICS 518 codes)

- Web search portals and other information services (NAICS 519 codes)

- Computer systems design and related services (NAICS 5415 codes)

It’s important to note that some of these services could instead be subject to Maryland’s 6% sales tax on digital products, digital codes, or other types of taxable services. The tax is expected to apply to sales for use in Maryland (generally where the buyer is located or receiving the benefit of that service).

Businesses should consult with their tax professional to evaluate whether their offerings are subject to the new 3% rate or another existing rule.

Income Tax Increases for High-Earning Individuals

Several changes will impact individual taxpayers with higher income, effective for tax years beginning after December 31, 2024.

- Capital Gains Surcharge

- A new 2% surcharge applies to capital gains for taxpayers with federal adjusted gross income (AGI) over $350,000.

- New Tax Brackets

- 6.25% rate on income over $500,000 ($600,000 for married filing joint)

- 6.50% rate on income exceeding $1 million ($1.2 million for married filing joint)

- Itemized Deduction Phaseout

- If your federal adjusted gross income (AGI) exceeds $200,000 (or $100,000 for those married filing separately), your Maryland itemized deductions will be reduced. The reduction will be 7.5% of the excess of federal AGI above the applicable threshold.

- Example: A married filing joint taxpayer with a federal AGI of $500,000 and $50,000 of itemized deductions will only be allowed to deduct $27,500 ($300,000 excess Federal AGI multiplied by 7.5% = $22,500 reduction to itemized deductions, bringing the $50,000 total down to only $27,500 allowed).

- Higher Local Income Tax Rates

- Some Maryland localities will now be permitted to raise their local income tax rate caps from 3.2% to 3.3%.

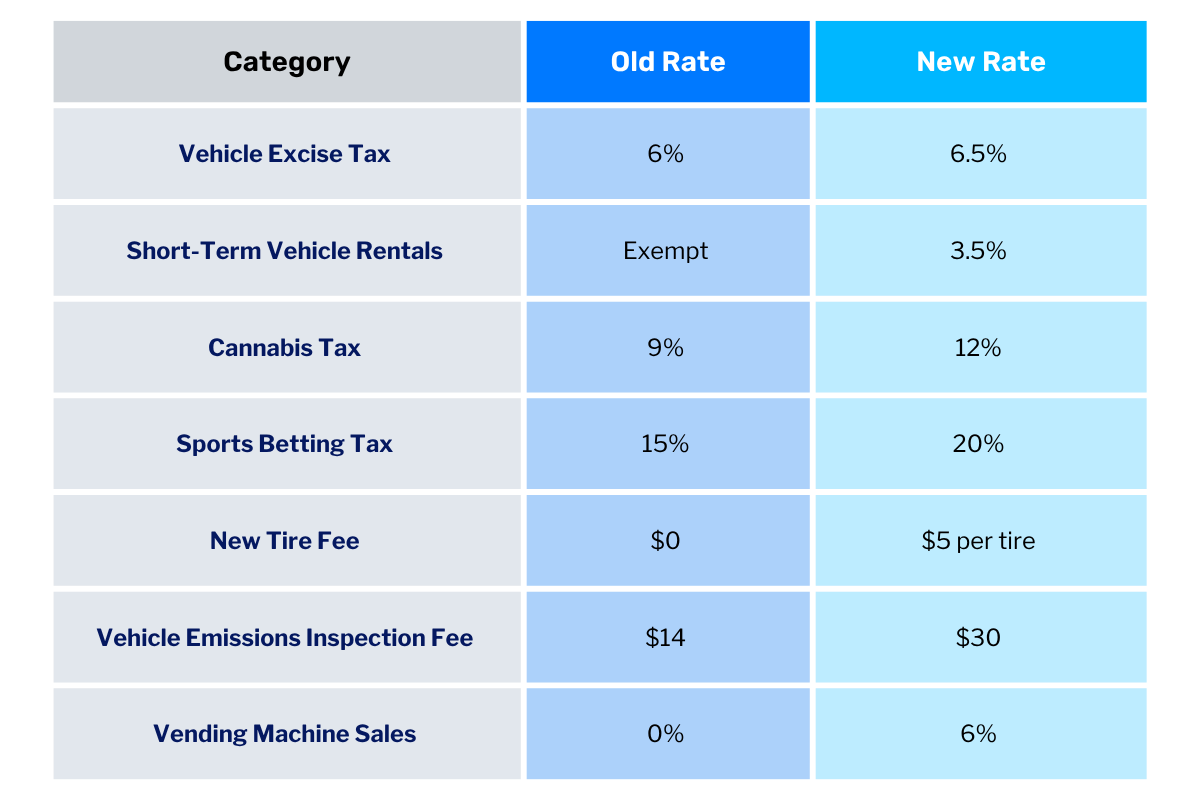

Fee and Excise Tax Increases

Several additional tax and fee increases were also approved:

These changes have wide-reaching implications for Maryland-based businesses, high earners, and anyone providing or purchasing tech services. It is important for taxpayers to prepare themselves by talking with their advisors and tax professionals to implement tax planning strategies and stay informed as new guidance is issued.

- Businesses should begin assessing their service offerings and pricing models now to prepare for the upcoming tech tax.

- Individuals may want to revisit their 2025 estimated payments or withholding and consider planning moves such as:

- Timing capital gains recognition

- Maximizing retirement contributions

- Evaluating charitable contributions

Need Help Navigating These Changes?

Our Tax team is closely monitoring new guidance and implementation details. If you have questions about how these updates may affect your business or personal tax planning, we’re here to help.

Contact our team today if you have any questions about the digital sales and income tax increases or want to speak with a tax professional.