No, technology is not taking our jobs—but it is giving us an opportunity to step into more impactful, value-driving roles as finance leaders. And upskilling to address new digital and technical skill gaps is key to making the jump.

AI for CFOs: Freeing Up Your Time to Add Value

AI is trending everywhere today. Technology like machine learning and artificial intelligence are automating simple processes to create productivity gains and time savings that were previously unattainable. From streamlining monthly close and management reporting to aiding decision-making, finance teams are rightfully assessing where these tools fit. As such, they’re faced with two issues:

- Having the right skillset and tools to take advantage of AI, and

- Determining the future skills their team will need to capitalize on the time regained once AI is deployed.

As AI automates familiar but manual, recurring tasks—saving hundreds of hours of time annually to focus on high-value activities—finance teams need to retool themselves to be proficient at driving financial transformation. But what skills does your finance team still need to develop to add real value?

3 Critical Skills for Finance Transformation

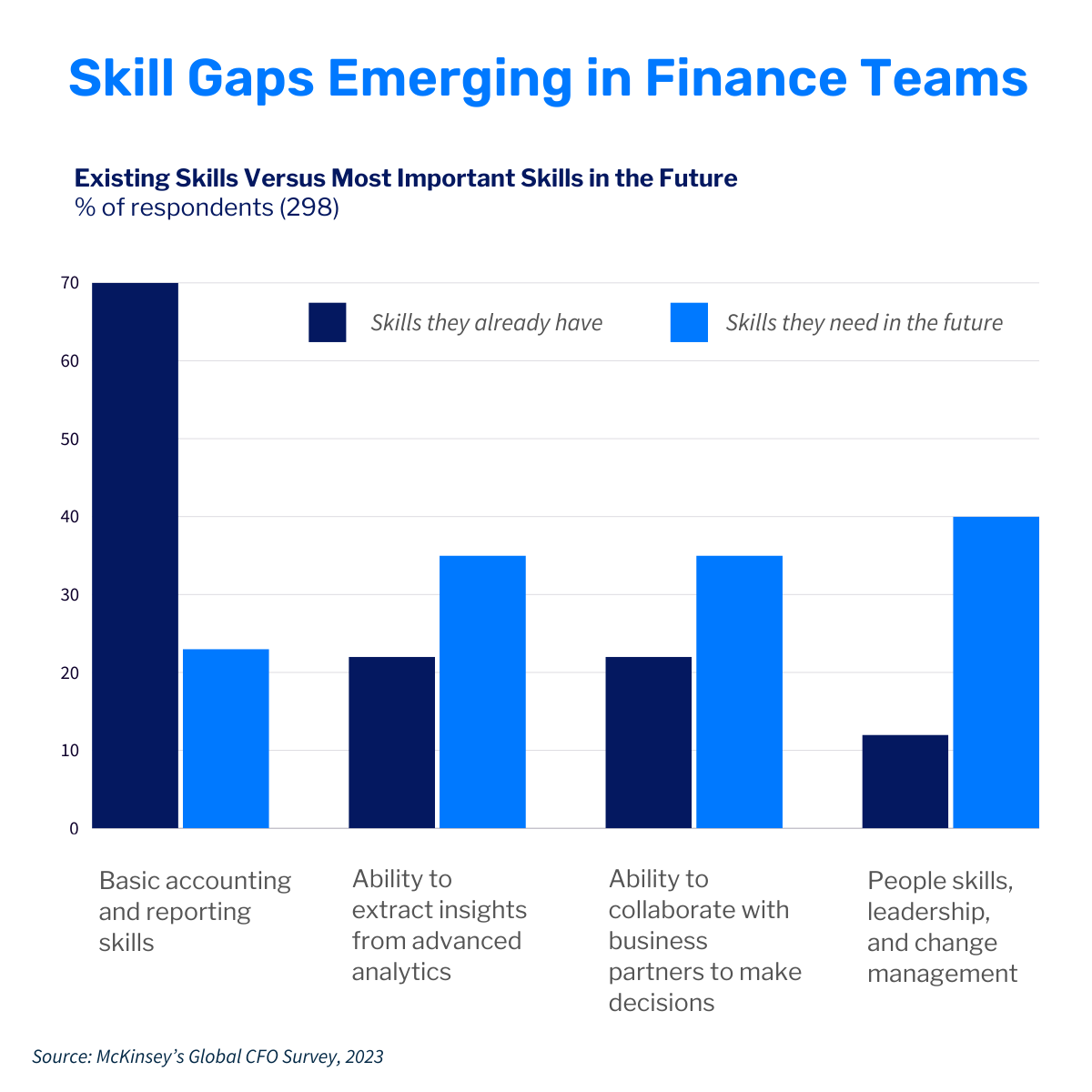

The finance function’s accelerated shift from informer to impactor creates a new demand for skills that were previously not a priority for the finance function. AICPA research shows that finance leaders identified three key competency gaps across the finance organization:

1: Data-Driven Technology Capabilities

Data modeling and data science skills to analyze, interpret, and communicate insights from large and complex data sets. A precursor to these skills is a finance and accounting team that has strong experience with their ERP and EPM solutions.

How this skill gap might appear in your business:

- Unreliable or inaccurate Financial Planning & Analysis (FP&A): Setting up data models and interpreting the output accurately is a daily struggle. Mistakes in forecasting can lead to overestimated revenue and misallocated resources.

- Inability to extract data insights: The finance team is forced to look in ten different places to pull data, which means missing out on valuable opportunities for revenue optimization or cost savings.

2: Business Strategy & Collaboration

Business acumen and the ability to work effectively with other functions and stakeholders in the organization to make strategic business decisions.

How this skill gap might appear in your business:

- Inability to think big picture: Finance teams are well-versed in historical reporting, but they struggle to connect financial performance to overall business strategy. And when insights are extracted, visualizing and presenting them to stakeholders effectively is a challenge.

- Siloed decision-making: Finance leadership doesn’t fully understand the strategic importance of other departments’ initiatives, more focused on hard numbers like immediate costs/returns and stifling long-term growth.

3: Leadership & People Skills

Demonstrated leadership, adaptability, and change management skills to effectively communicate evolving business needs, drive innovation, and make strategic decisions to move the business forward.

How this skill gap might appear in your business:

- Change fatigue and resistance: Constant technology churn and evolving expectations have led to burnout and skepticism on finance teams. The lack of employee buy-in and understanding of the benefits of new initiatives is hindering the adoption of new software and processes.

- Innovation stagnation: Conservative leadership and/or a risk-averse culture stifles innovation and the adoption of emerging technologies. Without effective communication about future-forward strategies, employees don’t feel empowered or inspired to experiment which can mean missing out on critical advancements that give your business a competitive edge.

The Future Finance Skillset: What Can’t Be Automated?

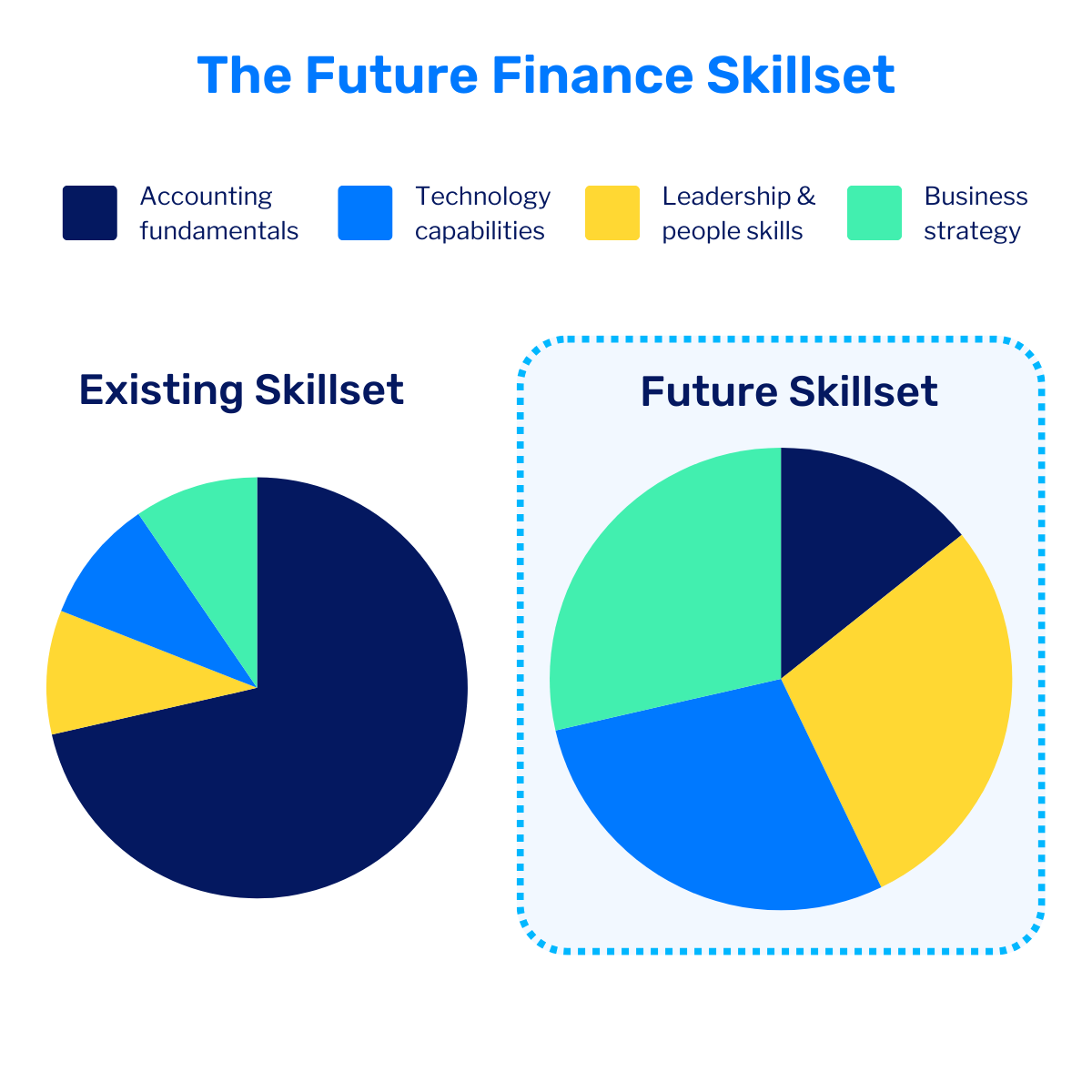

These skillset gaps expose a running theme throughout the finance industry. For too long, we’ve focused on hard skills like accounting, budgeting, and reporting. These are the prime tasks that AI and ML technology can support (or perform altogether).

As a result, the softer skills—like communication, leadership, change management, and business strategy—were historically overlooked. And these are the skills that differentiate us from even the most advanced technology. As AI and automation advance quickly, it’s clear that finance teams must focus on closing the skills gap to stay ahead.

The future of finance skillset is focused on the tasks that cannot be automated and require human judgement, creativity, and strategic thinking to add value. Finance teams need to focus on upskilling these qualities to stay competitive (and relevant).

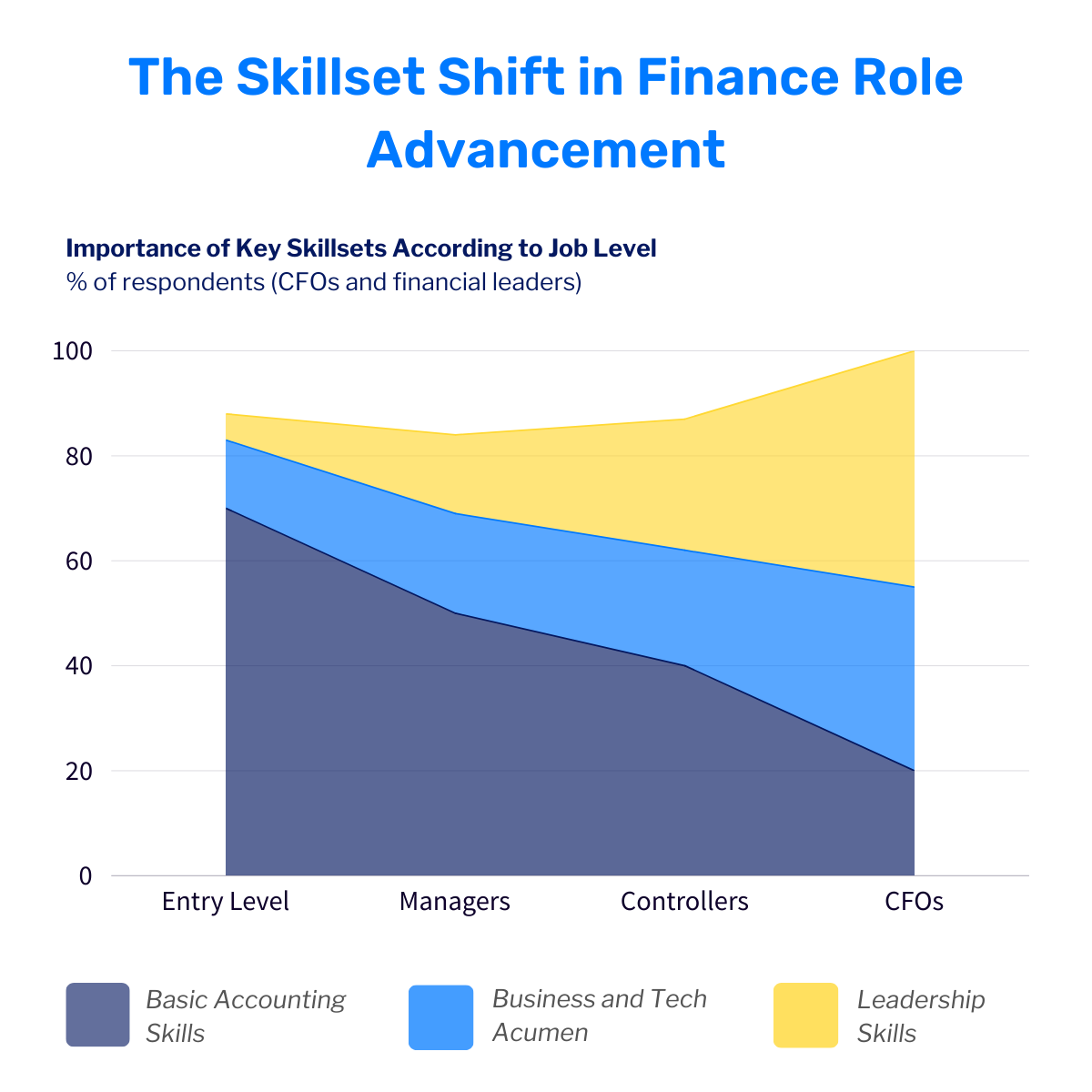

Upskilling isn’t just valuable for business, it’s also valuable for individuals to move up in their careers. An AICPA survey of finance leaders reinforces that basic accounting knowledge becomes less important as the financial role evolves. Skills regarding technology, business acumen, and leadership become requirements for advancement, making them critical for success.

Establishing a Solid Tech Foundation is Critical

Addressing skill gaps is critical, but all the strategic thinking in the world won’t matter if you don’t have a solid foundation of well-implemented ERP and EPM technology. And vice versa—the shiniest, newest AI tools won’t benefit your business if you don’t know how to use them. The skillset of your finance team must be addressed in tandem with your tech stack.

A solid tech foundation for enterprise CFOs and finance leaders must include:

- An ERP system to act as a centralized location for financial data

- An EPM or CPM software that facilitates close consolidation, planning, budgeting, forecasting, and reporting processes

- A data analytics platform to create data visualizations and dashboards that uncover actionable insights faster

Future-thinking CFOs agree that a lack of critical foundation elements like data governance, security, strategy, and skilled resources are the biggest obstacles to incorporating GenAI into their business.

Strengthening your tech stack and upskilling your team while managing day-to-day financial operations can feel impossible without extra help. One way to tackle these challenges faster is to work with a managed services partner.

The right outsourced partner will help you address both without wasting time or resources. They’ll work with your stakeholders to develop a comprehensive upskilling program while deploying a team of experts to optimize your technology (or help you select and implement new solutions). Learn how SC&H’s finance transformation team can help you tackle finance modernization without depleting your bandwidth.

Close the Skill Gaps to Attract and Retain Top Finance Talent

An open mindset to new technology and skillsets is critical to building a competitive finance function. The finance talent pool is shrinking at a historic rate, and demonstrating your dedication to finance modernization can attract top talent while retaining the talent you already have. Closing the skill gap includes three key areas of focus:

- Foster collaboration across leadership: Finance and IT can no longer be siloed. Leaders must understand how to use finance technology before motivating their team. It’s ultimately their responsibility to train the staff (and the trainers) to be adept at analytics, interdepartmental collaboration, and strategic thinking.

- Invest in your current staff: Fostering an adaptive, open mindset to change is key to ensuring existing teams are excited about transformation. Leaders should encourage continuous learning and lead by example when establishing effective learning systems.

- Attract top finance talent: Attracting, hiring, and retaining a younger generation of talent that grew up with technology is a challenge for lagging organizations. Young professionals have much higher technology and innovation expectations. They’ll happily pass over organizations with antiquated technology for future-forward organizations that will provide them the opportunities they want to build their tech skills and advance their careers.

Staying agile and up to date with technology is the underlying theme here. A global finance survey found that nearly half of CFOs (48%) plan to invest in technology to streamline finance tasks. Even more striking, nearly all (99%) of those CFOs agree that digital transformation will be crucial for both attracting and retaining employees. To stay ahead of the pack—or even just to avoid falling behind—adapting and evolving is critical.