Investment Banking & Advisory | Illinois

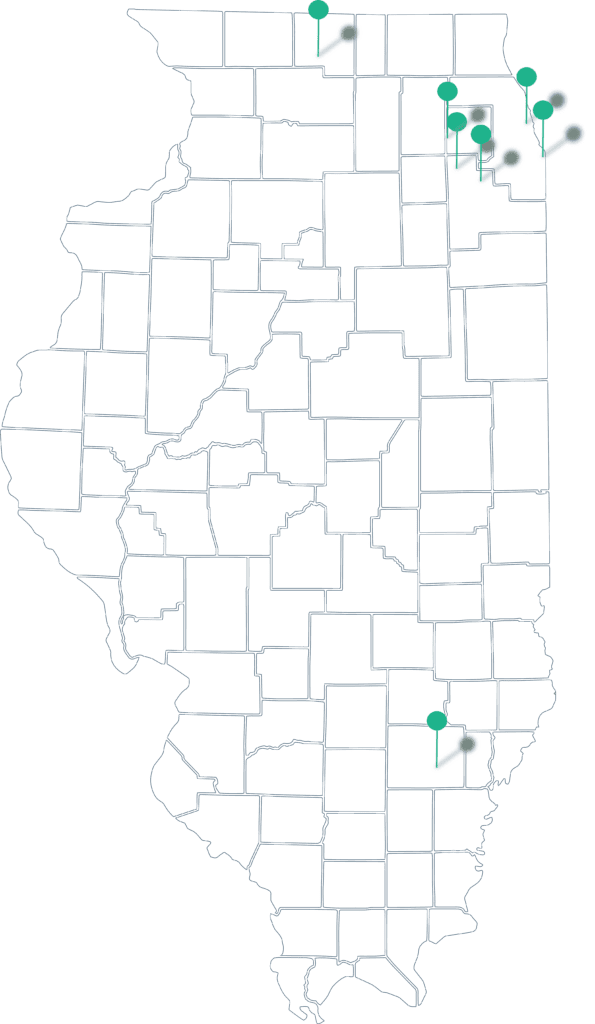

M&A Solutions for Middle Market Businesses in Illinois

SC&H Capital is an investment banking and advisory firm specializing in mergers and acquisitions (M&A), employee stock ownership plans (ESOP), special situations M&A, and business valuations for middle market companies. Our innovative thinking and unmatched execution deliver outstanding results for Illinois business owners.

Demonstrated Financial and Advisory Expertise

Get the best possible solutions to realize your goals by utilizing our team’s broad experience in diverse transactions and independent advice. We have completed over 800 M&A advisory, financing, restructuring, and ESOP transactions with an overall economic value of over $11 billion.

Mergers and Acquisitions

Get maximum negotiating leverage and optimal results for your privately held Illinois-based company with expert advice that stems from extensive experience designing and executing sell-side M&A processes.

Employee Stock Ownership Plans (ESOP)

With a deep understanding of the regulatory, tax, and financing complexities and opportunities that ESOP transactions present, our team can structure and execute ESOP transactions for companies, trustees, and selling shareholders.

Special Situations M&A

We partner with Illinois bankruptcy attorneys, chief restructuring officers, creditors, and business owners to provide valuable insights, a proven process, and the right distressed M&A approach to address difficult situations—oftentimes in as little as 60 days.

Business Valuation

We deliver informed valuations for ESOP administration, financial reporting, estate, and gift tax compliance, 409A compliance, fairness opinions, shareholder disputes and/or other litigation matters backed by broad industry experience.

Boutique Firm Attention, Large Firm Execution

Our engagements are more than just transactional. We focus on the planning, understanding, and positioning of the business throughout the entire transaction lifecycle to assure the best advice and solutions. For our clients, this means a tailored transaction that strategically aligns with clearly defined objectives; for referral sources, this means peace of mind that your clients, borrowers, and/or shareholders are receiving the most informed guidance.

Investment Banking That Transcends Industries

SC&H Capital provides measurable business results through broad knowledge that spans leading industries in Illinois. The State is home to a multitude of well-respected family and founder-owned businesses, from manufacturing and food processing to trusted B2B service providers, agribusinesses, and vital healthcare companies. Our unparalleled experience in these industries and insight into buyers in the middle market makes us the investment bank of choice for business owners in Illinois.

Business & Professional Services

Government Contracting

Healthcare

Manufacturing

Technology

Agribusiness

Service Our Referral Sources Can Trust

Our team is dedicated to cultivating trusted, long-term relationships with attorneys, wealth managers, accountants, and bankers. Our referral partners trust us to go deeper, solve complex problems, and find and capture more value for shared clients. No headaches for you and goal-driven success for your clients. We make you look good. Period.