In today’s Strategic Whiteboard Series, SC&H’s Kelsey Finnegan offers up concrete advice and accounting/finance best practices for government contractors looking to maximize their potential.

Video Transcription

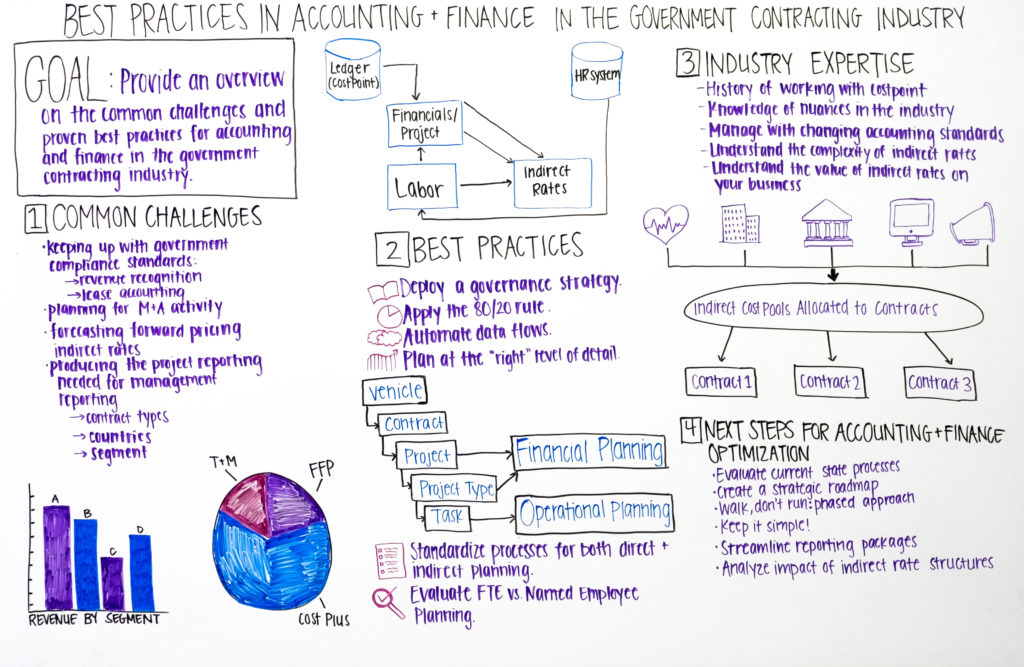

Hi, my name is Kelsey Finnegan and today I’m going to talk about the best practices for accounting and finance in the government contracting industry. Our goal for this session is to provide an overview for the best practices and common challenges that we’ve seen in accounting and finance in the government contracting industry. And once I’m done talking about those two topics, I’m also going to go into why having industry expertise is so important as well as the next steps that your organization can take to create an accounting and finance optimization strategy.

Common Challenges

So, the first thing I’m going to go over is common challenges that we see in this industry. The first one being able to keep up with the accounting government standards. Oftentimes, whether it’s the new lease standards that came out or the revenue recognition standards, without a system in place in your accounting and finance organization a lot of government contractors struggle to pull the data together for these ever-changing standards.

A great example is the revenue recognition standards — whether it’s being able to report correctly by contract type by status or country of your projects and really being able to slice and dice your data and project detail by those different pieces in order to keep up with the government standards. Another big one is having a strategy in place to keep up with the amount of M&A activity that we see in this industry. So, there’s a lot of mergers and acquisitions activity and having a consolidation system in place for your accounting team is crucial to be able to handle the volume of acquisitions that we see in this industry.

The next one is being able to properly forecast your forward pricing rates for your indirect rate submissions. A lot of big companies that we see do this even in Excel today and that can be an error-prone system with minimal visibility into your rates and what’s building up that data — putting a standardized system in place for that can be really helpful. It will give you visibility into the reporting that you’re looking for. And the last one that we see is related to the government standards, but being able to slice and dice your project data by the different reporting pieces that you need for management reporting. I mentioned some before but being able to see by contract type where your revenue is coming from whether it’s mostly T&M based, cost-plus, firm fixed price, what are my different slices of projects that I see. Another big one is just being able to see your EBITDA, or revenue by segment. Being able to consolidate all your project detail and do that reporting that you need can be critical to running your organization from a management perspective.

Industry Best Practices

So, the next thing I want to talk about is best practices to help resolve some of these common challenges in the industry.

Deploying a Governance Strategy

One thing that we see a lot of companies in this industry struggle with is having standardized processes around their fields, or different pieces of metadata they need to be able to produce their management reporting — a great example of this is the different levels in your project structure, and keeping that standardized throughout the company. Another great example is having a standardized project labor category. We see a lot of companies that have a hundred different computer engineers and it can be challenging to do analysis on project labor categories if they’re not standardized across your organization.

Apply the 80/20 Rule

The second one is applying the 80/20 rule when going through these accounting and finance transformations. This just means keep it simple. A great example of this would be making sure that what you put in place really applies to your main segment.

Make sure that 80 percent of your business is able to use the standardized application or strategy that you’re putting in place and you may want to implement or put together a strategy in the future for the remaining 20 percent or those other smaller segments that may have more nuances or complexity in their processes, but starting with the big areas of your business can give you the most value at the beginning.

Automating Your Data Flows

This is critical especially in this industry because there’s so many types of data and information that’s really useful for your reporting—whether it’s pulling different opportunities that you’re working on for future projects, pulling in your child balances or different slices of your burdened detail—having all of that information flow through for standardized actual reporting, and also your forecasting and budgeting is critical so that you have faith in all of your numbers that you’re pulling on your reports.

Plan at the Right Level of Detail

When talking about the different project levels that you may have in your general ledger, understanding that the lowest level of detail is more going to be for your operational planning but most likely to plan or forecast accurately you’re going to want to do that at a higher level of detail so it doesn’t put a burden on your team and you’re still able to get the analysis that you need from a reporting perspective.

The next two are related.

Standardized Processes for Direct & Indirect Planning

So being able to stand or standardize those processes for both direct and indirect planning can be critical. This also is related to how you want to plan your workforce, or your people. From a direct standpoint that’s going to drive revenue for some of your contracts potentially and you may just want to build this up by FTE. You may have contracts that have 500 plus people, they have a lot of turnover and it might not be worth it to plan by person, but on your indirect side where you want to build up the costs of each of your departments or your pools accurately, it could be really critical to plan those costs by person.

So, thinking through your different options and coming up with a process that’s going to work across your organization—for both your direct and indirect—is important to think about. Now that we’ve talked through the common challenges and best practices in the industry, I want to talk about why having industry expertise is so important. Having someone either internal on your team as a project manager to undertake something like transforming your accounting and finance processes, or external to help you with those things, is critical.

And the first example of this is having in-depth knowledge of your general ledger—which a lot of times in this industry is Costpoint. For larger government contractors, we see Costpoint as the general ledger. And it’s crucial to have an in-depth knowledge of how the pool structures work within Costpoint, how those allocations work, and how that’s really going to flow through into your forecasting and planning processes. How are we able to pull information out of Costpoint so we can get different slices of our burdens whether we want to see things that target or at actual rates? Having someone that has that knowledge of how Costpoint works can be critical to getting the reporting that you’re looking for.

Nuanced Industry Knowledge

The second one is just really having the knowledge of the nuances in the industry. And this really in my opinion relates to the indirect rates and just understanding how not only important but how complex that is for your organization. So, having someone that understands how it works on Costpoint and how that really needs to translate into your forward pricing rates is critical.

Being able to see those four fully-burdened P&L’s is important for your reporting and just making sure all that information flows properly from both an actuals and forecasting and budgeting standpoint is crucial.

And really also going back to the accounting standards is having someone that understands that the accounting standards that the government puts out changes on an annual basis and having a system in place that’s able to collect those different standards and be able to be flexible as things change is also important.

Next Steps

So finally, what are the next steps for trying to put something in place to update your accounting and finance processes? What do I do next? And the first thing is to look at your current processes. Where are your issues today? Where are you seeing some overall gaps in your process and different things that would be helpful to streamline in the organization. And secondly, it’s to create a strategic roadmap. Let’s think over the next one to three years what are the different things that my organization needs to put into place to be able to achieve the end goal of having better reporting and more—to have more faith in your reporting numbers as well.

The first piece of advice once you do those things is to have a phased approach—walk, don’t run. If you want to put in a new consolidation system to be comfortable with your actuals—be able to get that Mergers and Acquisitions data into your consolidated numbers quickly—that could be a first phase. Then being able to plan for direct employees or direct project data direct revenue, that’s important. And then of course your indirect rates and being able to do what-if analyses, being able to do analysis on the reorganization of your company and see how that’s going to flow through to your rates and how that would impact your business. Doing those things in a phased approach would make sure that you’re more successful. And of course, keep it simple. As I mentioned before applying the 80/20 rule, focus on your first two biggest segments. Make sure that the big core pieces of your business can operate in a system and you can layer on additional potentially more complex segments later. Through all these different pieces of transformations, the goal is to have a streamlined reporting package so you have faith in your numbers, you can pull reports with different slices of your project detail, and even from an indirect rate perspective the goal would be to know where the base data was coming from—you know that your project managers built up that information and that the real employee detail and all the cost and all those pools are also at the click of a button for you—and it’s not a manual effort in Excel.

So that’s all I had for today. I hope this was helpful. My contact information is below the video on the website landing page. If you have any questions, feel free to reach out to me via email address or phone (703-852-5613). Thank you! Have a great day.