Authored by Amanda Haase, CPA, CIA | Senior Manager, Contract Compliance Audit Services

Navigating the aftermath of mergers and acquisitions (M&A) is a daunting feat for business leaders. According to Harvard Business Review, 70-90% of mergers and acquisitions will fail. With the odds already stacked against an organization, having a clear, strategic integration plan to initiate after the deal closes is critical. Without effective post-merger integration, the combined organization may not realize the potential operational efficiency, cost savings, and revenue growth it hopes to achieve. Procurement plays a crucial role in minimizing the risk of value erosion and increasing the return on investment for strategic transactions.

In this procurement playbook, we’re sharing the key tenets of the integration process, potential risks, and how procurement plays a crucial role in successful integration.

What is Post-Merger Integration?

Post-merger integration (PMI) is the complex process of aligning and streamlining the operations of two companies to create a unified organization that can operate efficiently and effectively. This process begins after a merger or acquisition takes place and requires cross-functional collaboration between all aspects of the organization including procurement, legal/compliance, IT, finance, and human resources teams.

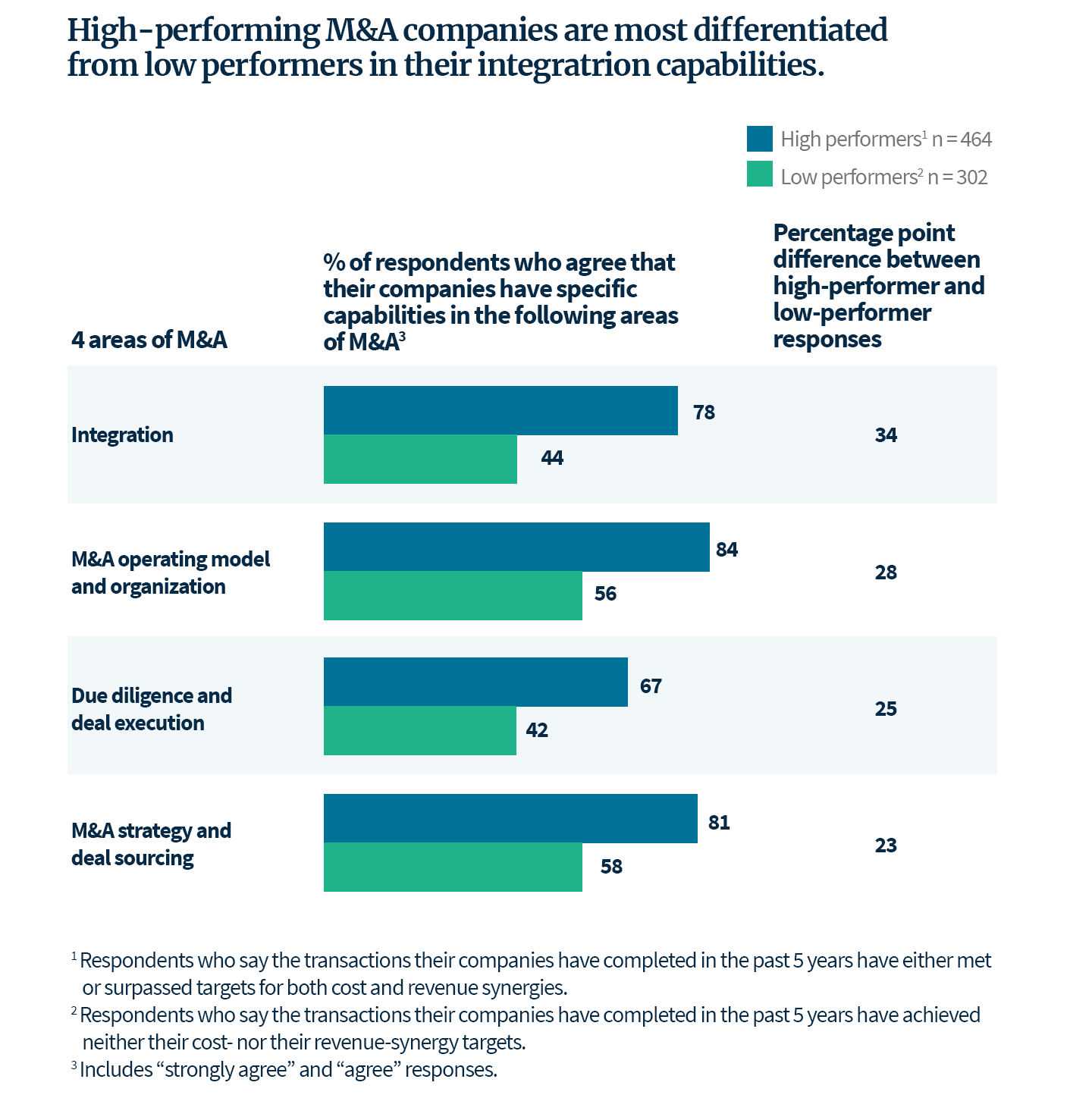

Research shows that effective integration plans are a key step in determining the long-term success of a merger or acquisition. According to a recent study, the greatest differentiator between high- and low-performing mergers is the ability to execute an integration plan. And those with effective integration plans deliver up to 12% higher total returns to shareholders.

Procurement Plays a Crucial Role in Post-Merger Success

External spending with third parties is often the largest share of a company’s costs, representing a golden opportunity for post-integration cost savings. Procurement is responsible for the majority of the organization’s spending and thus plays a key role in contributing to cost synergies.

Rising acquisition prices and a rapidly shifting economy are putting additional pressure on PMI teams to identify cost-saving opportunities. Furthermore, external spending is often an ideal pathway for organizations to cut costs without growing pains. Other money-saving avenues, such as employee reduction, are far less attractive from an operational and reputational perspective. An effective procurement team can drive significant cost synergies to increase the probability of long-term success for the newly merged entity.

5 Procurement Responsibilities to Drive Post-Merger Success

1. Leverage audit insights to negotiate optimal contract terms

Common contract issues such as overbilling, inconsistent pricing, complexities with most favored nations clauses, and suboptimal contract terms can erode the anticipated value of the integration. Therefore, managing the contract transitions, negotiating favorable contract terms, and ensuring contract compliance are key to achieving procurement synergy between the legacy companies. A contract compliance audit, performed by a third party following M&A integration, will bring these issues to the forefront, identify cost-saving opportunities, and increase supplier transparency.

2. Acquire more data to drive better insights

Organizations can leverage additional data acquired through the M&A process to gain a deeper understanding of third-party relationships, such as:

- Supplier data, including information about contracts, pricing, and supplier performance to identify new potential suppliers and negotiate better deals with existing ones.

- Spend data, like how much the company spends on different categories of goods and services to discover cost-saving opportunities.

- Contract data, including information about the terms and conditions of existing contracts with suppliers to identify opportunities to renegotiate contracts and ensure compliance with existing contractual obligations.

An effective integration plan manages this influx of data while maintaining data integrity to facilitate more informed decisions. Better decisions lead to increased efficiency and profitability.

3. Optimize spending through supplier assessment and consolidation

A comprehensive analysis of the newly merged supplier base is key to eliminating suppliers providing the same goods or services, negotiating better terms with strategically selected vendors, and consolidating suppliers to achieve cost savings through economies of scale. As a now larger, more valuable customer with increased spend, the newly formed entity can leverage additional bargaining power to drive lower prices and longer payment terms.

4. Maximize savings through price alignment

There are several ways procurement teams can remove redundancies and streamline processes to ensure the lowest prices are applied uniformly across the enterprise:

- Centralize procurement: Streamline all purchasing through a single department to eliminate duplicate spend, negotiate better prices with suppliers, and ensure that pricing is consistent across the entire enterprise.

- Standardize pricing agreements: Establish standardized agreements to identify pricing inconsistencies or inaccuracies, remove redundancies, and consolidate suppliers where needed.

- Benchmark prices: Evaluate whether the organization is paying competitive prices and negotiate with suppliers to bring prices down to a competitive level.

- Price governance: Set rules and guidelines for how prices are determined and how price changes are approved to ensure pricing decisions are made in a consistent, transparent manner.

- Procure-to-pay systems: Centralize procurement and payment processes across both organizations in a single platform to increase the visibility of spend data, supplier information, and contract terms.

5. Identify and correct errors that occur during the M&A

Errors during the transition period following M&A can range from simple mistakes in data entry to more complex issues with integration and process changes. An effective reconciliation process will compare the data from both entities before and after the M&A to ensure that everything has been properly recorded and integrated. This can identify data errors, procurement discrepancies, and contractual discrepancies that may have occurred during the transition. Failure to identify and correct these errors can lead to delays, increased costs, and reduced efficiency.

Potential Risks of Ineffective Integration Plans

If PMI is not executed correctly (or at all), the newly merged or acquired company is at high risk for margin erosion. As a primary concern for procurement teams, this impacts the organization’s ability to achieve strategic objectives and realize the expected benefits of the transaction. Without proper integration, margin erosion often shows up in the following ways:

- Reduced operational efficiency: The two companies may continue to operate as separate entities, quickly eroding or eliminating the intended synergies of the combined entity.

- Disruption and confusion: Uncertainty among employees, suppliers, and customers can result in delays, mistakes, and lost opportunities. A lack of clarity and confidence from shareholders can further erode a competitive market position.

- Excessive spending: Decentralized procurement operations, overlapping supplier relationships and contracts, off-contract spend, and lack of purchasing and pricing controls in the procure-to-pay process can lead to unnecessary expenses that reduce profitability.

- Loss of key talent: Employees may become dissatisfied and leave the company, resulting in a loss of key talent and lower employee morale. Hiring new talent is not only difficult, but it can also be a costly, time-consuming process.

- Compliance and regulatory risks: Failure to properly integrate legal and compliance functions can lead to regulatory and reputational issues that are costly to resolve. This can include fines, legal fees, or even legal action against the merged company.

An effective post-merger integration plan requires careful planning and execution from procurement teams. Successful procurement synergy will lead to maximized cost savings, additional purchasing power, and contracts harmonized with business processes to mitigate operational and financial risks.

Interested in leveraging expert support to help minimize risk and financial leakage in your post-merger integration plan while optimizing third-party relationships going forward? Learn more about how SC&H Group’s contract compliance audit services can help you plan for long-term success.