Authored by Nick Distefano and Ryan Schoppert | SC&H Financial Advisors, Inc.

The difference between the return on your investments before taxes and after taxes can be immense, but with strategic guidance from a qualified tax-focused financial advisor, your savings can be significant.

When it comes to capital gains tax, a tax-focused financial advisor can help you preserve more of your savings. Below we have outlined four reasons why you should have a financial advisor who can also give you strategic tax advice regarding capital gains tax implications.

1. Taking Advantage of the 0% Capital Gains Bracket

There are a few ways to take advantage of the 0% capital gains tax bracket, but for the average investor, it can be hard to navigate the rules. First, you need to understand the holding period for capital assets (home, personal use items, and stocks/bonds held for investment):

- Short-term capital gains: Assets held for one year or less. Short-term gains are taxed as ordinary income and are not subject to favorable capital gains tax brackets.

- Long-term capital gains: Assets held for over one year. When sold, they are subject to a series of tiered preferential rates ranging from: 0%, 15%, and 20% (and for married couples with modified adjusted gross income above $250,000, an additional 3.8% net investment income tax).

If you are married and have a taxable income of less than $83,350 or are single with an income of less than $41,675, you may be able to take advantage of the 0% capital gains tax bracket.

But even if you are hovering between the 15% and 20% brackets, you can still take advantage of some strategies. For example, if you know a big promotion or bonus will increase your income past $517,200, it would be in your best interest to recognize capital gains while you are still in that 15% bracket, saving you 5% when you get the raise and bump to the 20% bracket. Here’s how to recognize these capital gains:

- Harvest capital gains up to the correct tax bracket threshold.

- If you still want the asset, buy it back immediately. This is equivalent to receiving a free step-up in basis.

- Don’t recognize excess capital losses if eligible for 0% rates. Capital losses can only offset $3,000 of ordinary income. Beyond that, there is no immediate tax benefit.

- Pay attention to the impact on other tax deductions, like itemized medical expenses, the indirect taxation of social security income, and eligibility for other tax credits.

Before implementing a strategy like this, taxpayers should consult with a financial advisor who understands your full financial and tax picture. Those most likely to benefit from the strategies noted above are retired individuals and couples, those in between jobs, or young adults who are just beginning their careers. The possibility of capital gains taxes increasing in the near future makes it crucial to plan for capital gain recognition events on an annual basis.

2. Impact of Ordinary Income on Capital Gains

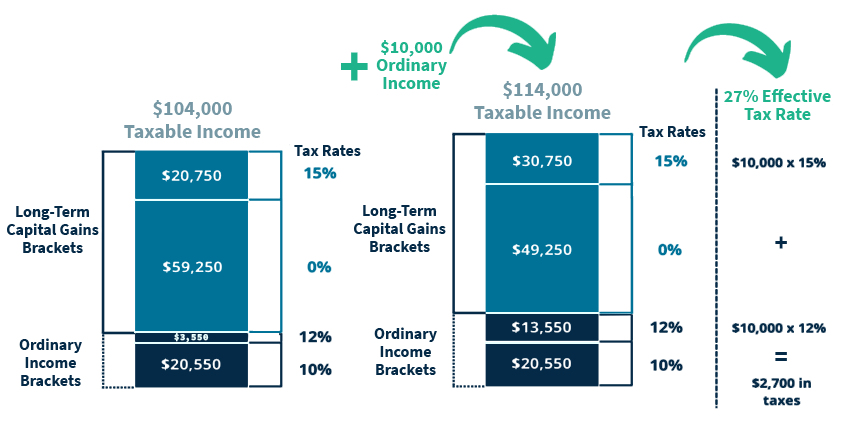

Capital gains stack on top of ordinary income to determine the relevant capital gains and income tax brackets. Here is how that works, in order:

- Available deductions are applied against ordinary income to identify the proper ordinary tax bracket.

- Capital gains are stacked on top to determine the appropriate capital gains tax bracket.

What is important to consider here is that, while your ordinary income level will affect your capital gains tax bracket, taking on more capital gains won’t affect your ordinary income tax bracket. This also means that increasing ordinary income can crowd out lower capital gains tax rates.

Long-Term Capital Gains vs. Ordinary Income

High Effective Tax Rate with $10,000 Additional Ordinary Income Example for Married Filing Jointly

A financial advisor with little knowledge of tax laws may recommend a $10,000 Roth conversion to fill up the 12% bracket, inadvertently increasing a client’s taxes. This $10,000 will become ordinary income and be taxed at 12%, but because of how taxes are stacked, it will push $10,000 of capital gains from the 0% bracket into the 15% bracket, resulting in a 27% tax rate on that $10,000.

Our tax-focused financial advisors are intimately familiar with this interaction and its impact on Roth conversions.

3. Capital Gains Planning in Retirement

In retirement, income flexibility requires a higher level of proactive planning and attention to detail. In addition to understanding the tax implications of required minimum distributions, pension income, harvesting capital gains, and Roth conversions, your financial advisor should also understand how each affects the taxation of Social Security and the Medicare income-related monthly adjustment amount (IRMAA).

If you plan on leaving assets to your heirs, it is important to consider a step-up in basis. This can be a valuable strategy because it makes capital gains during your lifetime tax-free for your heirs. By using a 360-degree approach, our goal is to minimize your lifetime tax rate and those of future generations by providing comprehensive financial planning.

4. Donation of Appreciated Securities to Avoid Capital Gains

It feels good to donate some of your wealth to a worthwhile cause, and it helps the charitable organization achieve its mission. It is truly a win-win situation. But you may not know that giving cash to a charity is not the most tax-efficient way to accomplish this goal.

If you donate appreciated securities to the charity instead, you can avoid capital gains on the appreciation. The fair market value will be deducted from your taxable income, and the charity won’t be taxed on the capital gains either.

Because of the substantial increase to the standard deduction to $25,900 in 2022, you may have a much larger hurdle to receive a tax benefit from charitable giving. Our team can work directly with you to build a custom strategy that fulfills your giving wishes while maximizing tax deductions and minimizing capital gains tax.

With strategic tax planning, you will be able to navigate these capital gains strategies to maximize your return on investment. At SC&H Financial Advisors, we can help you make sense of capital gains taxes, effectively incorporating tax planning into your future financial goals. To learn more, contact us.