Authored By Angelo Romano, CFP® | Financial Advisor, SC&H Financial Advisors, Inc.

Whether you are just starting your first job, or you only have a few years left in the workforce, retirement is something that everyone needs to prepare for. Proper planning and an adequate savings strategy can be the difference between living the life you have always dreamed of or delaying retirement until long after you desire.

Retirement planning can be intimidating and, for some, downright scary. Between employer plans and individual retirement accounts (IRAs), it can be enough to make your head spin. So, let’s take a few minutes to outline some basic retirement options and things to consider when saving for your future.

Employer Plan Types

These days, most companies offer some type of retirement savings plan for their employees. Below is a brief description of two of the more common employer-provided plans:

- 401(k) plan: This is a tax-deferred savings plan that an employer offers to their employees to save for retirement. These are commonly used by for-profit companies.

- 403(b) plan: This is a tax-deferred savings plan that is like a 401(k) plan. The main difference is that 403(b) plans are offered to employees of public schools and other tax-exempt organizations.

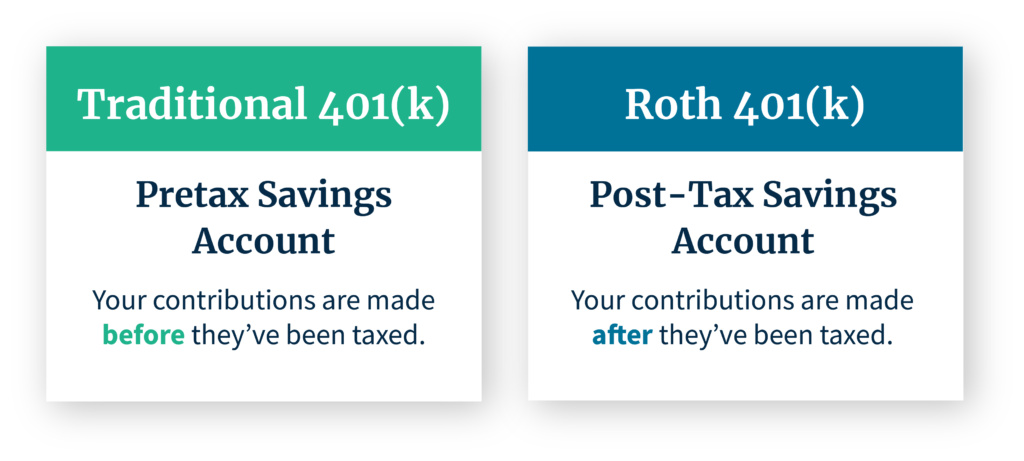

Traditional Savings Option

The employer may choose to offer a Traditional savings option as well as a Roth savings option in either a 401(k) or 403(b) plan. With a Traditional plan, the employee can save on a pre-tax basis. This means that the amount contributed to the plan is deducted before taxes are calculated. This option allows the employee to receive a tax deduction for the amount contributed to the plan, up to the maximum contribution limit of $20,500 (an added catch-up contribution of $6,500 for participants over age 50) for tax year 2022. Since the employee is contributing before tax, they will have to pay ordinary income tax on distributions from the plan in retirement.

Roth Savings Options

In a Roth option, the employee can save on an after-tax basis. This means that the amount contributed to the plan is deducted after taxes are calculated. The contribution comes from the employee’s net pay and does not qualify for a tax deduction on their current year’s taxes. The main benefit is the tax treatment of the growth. With a Roth plan, all growth is tax-deferred and can potentially be tax free if certain requirements are met upon withdrawal.

Similarities Between the Traditional and Roth Savings Options

While plans will differ by employer, there are some commonalities to consider:

- Employer plans may offer an employer match contribution to incentivize employees to take part and save. This is when the employer contributes a certain amount to your retirement based on your annual contribution amount. For example, an employer may match 100% of the participant’s contribution up to 3% of their salary.

- Most plans offer age-based or target-date funds in their investment choices. A target-date fund is a mutual fund, which is designed to help you manage investment risk. As you near your retirement age, the fund reduces its stock exposure which may result in less volatility but also less return potential. The plan may also offer mutual funds in various asset classes that allow the participant to customize the allocation, giving them more control of their investments.

- Each plan will allow you to name a beneficiary to receive the funds in the event of your passing. This is something that should be reviewed regularly.

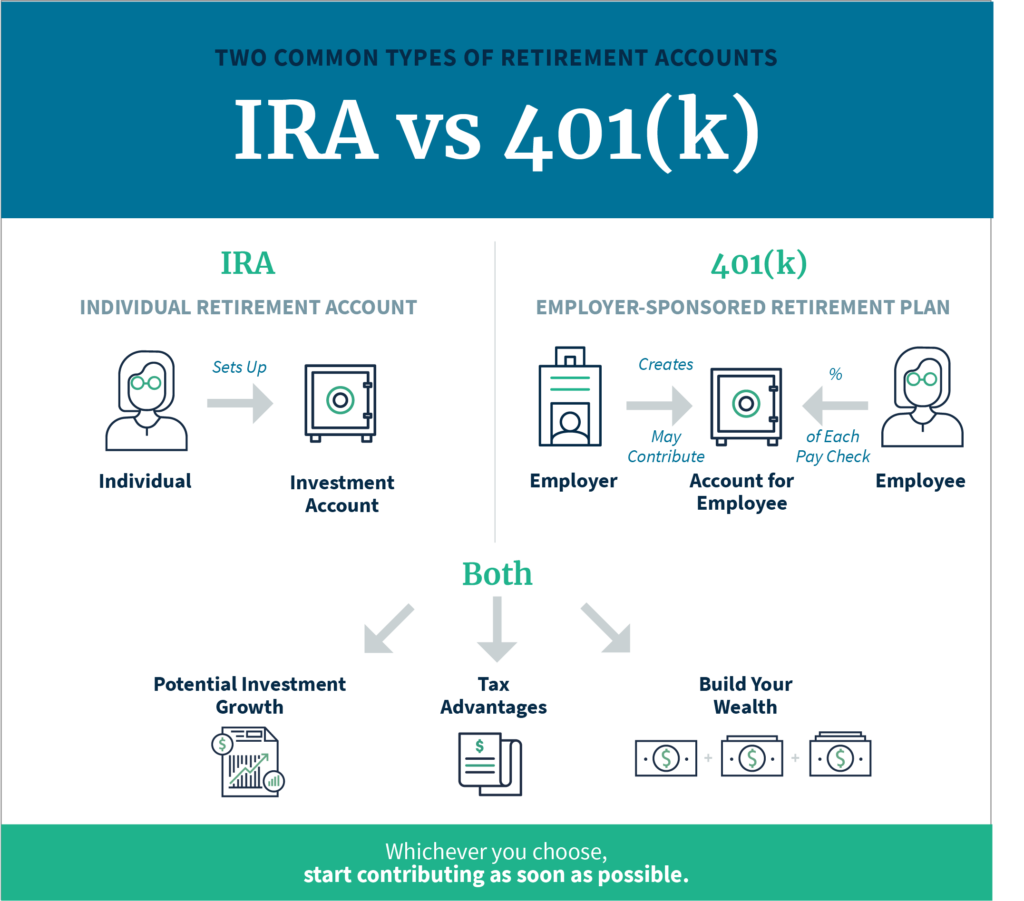

Individual Retirement Accounts (IRAs) Explained

What if you work for an employer that does not offer a retirement plan? One choice you have is to contribute to an Individual Retirement Account (IRA). An IRA offers individuals tax-deferred savings for retirement, like an employer plan, but is opened through an investment company or financial institution.

IRA contributions can be made pre-tax or after-tax. Like employer plans, contributions to traditional IRAs are made pre-tax and are generally tax-deductible (income limits apply). Earnings grow tax-deferred, and you pay tax on withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning you do not receive a tax deduction in the year of the contribution. However, qualified distributions from a Roth IRA may be tax-free in retirement.

A few differences between IRA accounts and employer plans are contribution limits and investment options. For tax year 2022, individuals can contribute up to $6,000 to their IRA with an added catch-up amount of $1,000 for those over age 50. IRA contributions are also subject to income thresholds, based on your tax filing status. IRA accounts offer a wider range of investment options, giving the individual more control over portfolio allocation.

[sch_full_width_image]

[/sch_full_width_image]

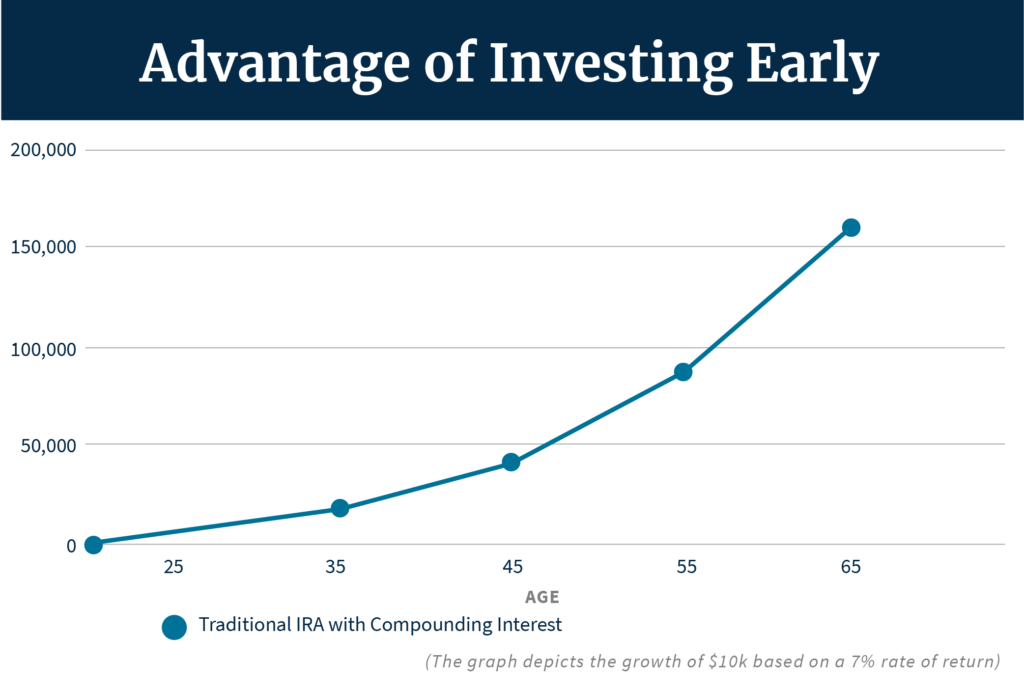

The Benefit of Compounding Interest

It’s never too early, or too late, to plan for retirement. However, the earlier you begin saving, the more compounding interest plays a factor. Compounding interest is the interest you earn on interest. For example, if you earn 5% annually on $1,000, you’ll earn $50 and have a total of $1,050 at the end of the first year. You will begin the second year earning 5% on $1,050 which includes your initial investment plus the $50 in interest that you earned previously. The earlier that you can start this process, the better. Below is a visual that shows the compounding effect for a person that begins saving at 25 years old versus a person who waits until 35 to begin.

[sch_full_width_image]

[/sch_full_width_image]

If you didn’t start saving for retirement on day one, don’t panic. Individuals over age 50 can make additional catch-up contributions to several types of retirement savings accounts.

How Much Should You Save?

A common question that most people ask is how much they should be saving towards retirement. This answer will be different for everyone and is ultimately determined by your needs and expenses. A good rule of thumb is to save 15% of your gross annual income towards retirement. However, a smaller percentage will still benefit your retirement in the long run. As you plan how much to save, consult with a financial advisor to determine the percentage appropriate for your unique set of financial circumstances.

As you save and your retirement account grows, you can use your current balance to help fine tune your annual savings target. This will help you to ensure that your current lifestyle will not have to suffer in your retirement years.

As you progress through your career and your income increases, so should your contribution percentage. Most employer plans offer an automatic annual contribution increase feature. This allows the participant to automatically increase their contribution percentage up to the maximum withholding amount. While investment returns are completely out of one’s control, proper funding of your retirement is not.

Review Your Retirement Plan Options Today

A trusted financial adviser can help you review your retirement account options and guide you on a retirement planning journey to help meet your financial goals. At SC&H Financial Advisors, Inc., we help our clients devise and implement retirement plans that are specific to their individual situations.

[sch_cta_box title=”Need Help Navigating Your Retirement Path?” button_label=”Contact Us” button_url=”https://www.schgroup.com/services/wealth-management/contact-us/” bg_image=” “]Whether you are starting your first job, need advice on what to do with an old employer plan, or are looking to retire in a few short years, our team can help.[/sch_cta_box]

“]Whether you are starting your first job, need advice on what to do with an old employer plan, or are looking to retire in a few short years, our team can help.[/sch_cta_box]

Advisory Services offered through SC&H Financial Advisors, Inc., an investment adviser registered with the U.S. Securities and Exchange Commission. SC&H also offers advisory services through the doing business as name of SC&H Core. SC&H Financial Advisors, Inc. is a wholly owned subsidiary of SC&H Group, Inc.

The information presented is the opinion of SC&H Financial Advisors, Inc. and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance.