On March 1, 2021, the Treasury and the Internal Revenue Service released additional guidance on the Employee Retention Credit (ERC) to supplement what had been issued prior to the passage of the Consolidated Appropriations Act (CAA) of 2021. The CAA expanded and enhanced the ERC and allows for employers to utilize both the ERC and the Paycheck Protection Program (PPP). The March 1 guidance, in the form of IRS Notice 2021-20, is focused on ERC issues relating to 2020. Future guidance will provide insight into implementing the expanded ERC in 2021.

[sch_pullbox] SC&H Key Takeaways

- The guidance largely follows the FAQs the IRS had issued on the ERC throughout 2020

- The Notice provides multiple examples of employers who had a PPP loan forgiven and now want to apply for the ERC for 2020

- This publication provides many definitional examples of an eligible employer as it relates to a partial or full shutdown

- A business that needed time to transition to a remote work environment may be deemed to have a qualifying partial shutdown for that period of time

- To claim credits for 2020, an employer will now need to file Form 941X for the affected quarter(s) [/sch_pullbox]

Employee Retention Credit under the CARES ACT

To understand the new guidance on the ERC, let’s first summarize the credit as it was established under the CARES Act.

Under the CARES Act, eligible employers are allowed a credit against payroll taxes for 50% of the qualified wages of an eligible employee for wages paid from March 13, 2020 to December 31, 2020. The maximum credit is $5,000 per employee. The credit is refundable if it exceeds the employer’s social security or railroad retirement tax due in a quarter.

To be considered an eligible employer, employers must meet one of two criteria:

- Covid-19 closure: The employer’s operations must be fully or partially suspended during the calendar quarter because of orders from an appropriate government authority due to Covid-19; or

- Gross revenue reduction: The employer’s gross receipts for the quarter are 50% less than the gross receipts for the same quarter in the prior year.

An employer has a significant decline in gross receipts in the second calendar quarter in 2020 when the employer’s gross receipts are less than 50% of its gross receipts for the same calendar quarter in 2019. An employer continues to qualify under this criterion until the first quarter after its gross receipts are greater than 80% of the same calendar quarter in 2019 or with the first quarter in 2021.

Qualified wages for the ERC depend on size of the employer:

- A small employer: 100 or less full-time employees during 2019

- Includes any employee paid wages during the fully or suspended period under the first criteria or during the applicable quarter for employers qualifying under the second criteria.

- Qualified wages include wages and employer health plan costs up to a $10,000 limit per employee.

- Each employee’s wages included are limited to the wages that were paid to the employee during an equivalent period during the 30 days immediately preceding the current period.

- A large employer: More than 100 employees in 2019

- The wages qualifying for the credit only include wages for employees not providing services due to the first or second criteria described above.

- A controlled group of corporations is considered a single employer for this purpose.

Read “Employee Retention Credit – A Second Look” in our SC&H Group Coronavirus Resource Center for additional details regarding the Employee Retention Credit under the CARES Act.

PPP Coordination

The CAA of 2021 now allows employers to utilize both the ERC and PPP relief programs. Many employers filed for PPP loan forgiveness prior to the enactment of this change. The Notice attempts to address how the two relief provisions can be applied by providing several examples.

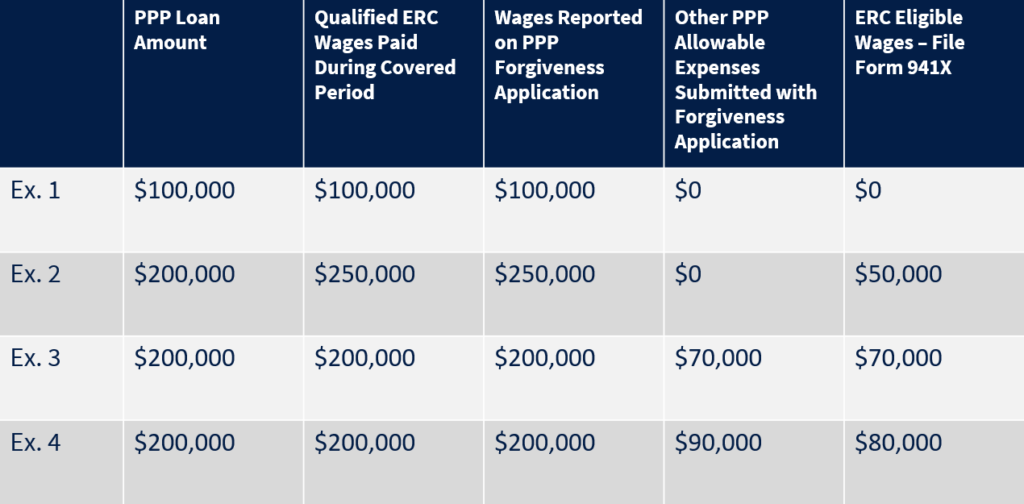

- Example 1 – no wages remain after utilizing them to receive full PPP loan forgiveness

- Example 2 – $50,000 of wages may be used to claim an ERC, since only $200,000 were applied to PPP loan forgiveness

- Example 3 – if the PPP forgiveness application did not include the $70,000 of nonpayroll costs, there would be no ERC eligible wages available to that employer – this is a tough pill to swallow if an employer just submitted payroll to make the forgiveness process easier. Here those additional expenses were included with the application and the employer has $70,000 of ERC eligible wages.

- Example 4 – allows for $80,000 of wages since at least 60% of the PPP loan must be spent on wages. 60% times $200,000 is $120,000, the remaining $80,000 of spend needed for forgiveness comes from the $90,000 in nonpayroll costs, leaving $80,000 of ERC eligible wages.

The key theme in all examples is that wages utilized to claim an ERC cannot also be used to apply for PPP loan forgiveness. The trick is understanding how to determine what wages are utilized between the two Covid-19 relief regimes. We have utilized the examples provided by the Treasury and summarized some of them in the table below.

Employers need to not file a PPP application and lose the opportunity to generate ERC benefits. An eligible employer for purposes of the ERC is deemed to have made an election to waive any potential ERC benefits for wages that were reported on a PPP loan forgiveness application – up to the minimum amount of payroll costs sufficient to obtain full loan forgiveness.

Wage allocations are deemed to first apply to the ERC (assuming the wages are ERC qualified). Wages not reported on a forgiveness application that are otherwise qualified wages under ERC rules are now eligible for the credit. Employers need to start coding their 2021 wages as ERC eligible if that applies and develop a plan to allocate wages between PPP 2.0 and ERC for 2021.

Full or Partial Shutdown Definitions

In a departure from the FAQs, the Treasury provided more insight into how an employer can meet the definitions of eligible employer as it relates to being subject to a full or partial shutdown.

- If an employer owns an essential business, it may have a partial shutdown if more than a nominal portion of its business are suspended by a governmental order. If the portion of the employer’s business represents more than 10% of either its total gross receipts or employee hours, it will be deemed to be more than a nominal portion of the overall business and the employer would be eligible for the ERC during the period of time the subunit was closed.

- If an employer needed time to pivot to a remote workforce, ERC could apply during the period of transition time. The catch here is that the period of the transition needs to be “significant,” which, as indicated in the Notice, beyond two weeks would meet that definition.

Other Issues Addressed

- The notice outlines the impact of the ERC aggregation rules and how the maximum credit is developed for each employee who was paid by more than one employer within the group

- Substantiation requirements for employers are discussed and a four-year retention period was recommended

Strategies

- Determine what wages will be ERC qualified wages in 2020 (applicable if you are an eligible employer)

- Determine which ERC qualified wages were NOT reported on a PPP forgiveness application:

- Wages paid prior to the PPP covered period

- Wages paid after the PPP covered period

- Wages not reported on the PPP forgiveness application – excess wages under PPP rules, wages you “didn’t need” to get to full forgiveness, etc.

- Build your spreadsheet with the PPP and ERC wages in separate buckets and apply the definitional limitations – keep in mind the $10,000 per employee limitation

- Factor in health insurance premiums as applicable for the $10,000 wage limit calculation

- Contact your payroll company and develop a plan to apply for the credit on Form 941X

- Keep in mind that if you applied for a PPP 2.0 loan, you almost certainly qualify for the ERC in 2021

Next Steps

Employers should carefully review the provisions above to take advantage of all potential credits. Careful attention should be paid to the ERC to determine potential qualifying wages considering the new and expanded provisions. Keep an eye out for our next installment on the ERC when guidance is published on the 2021 version of the credit, which will be even more valuable for many employers. In addition, the America Rescue Plan Act of 2021 is headed to the President this week and the ERC is slated to be extended through December 31, 2021.

If you have any questions on any of the credits discussed above, please contact the SC&H Tax Team.