Authored by Jen Amato | Director, Audit

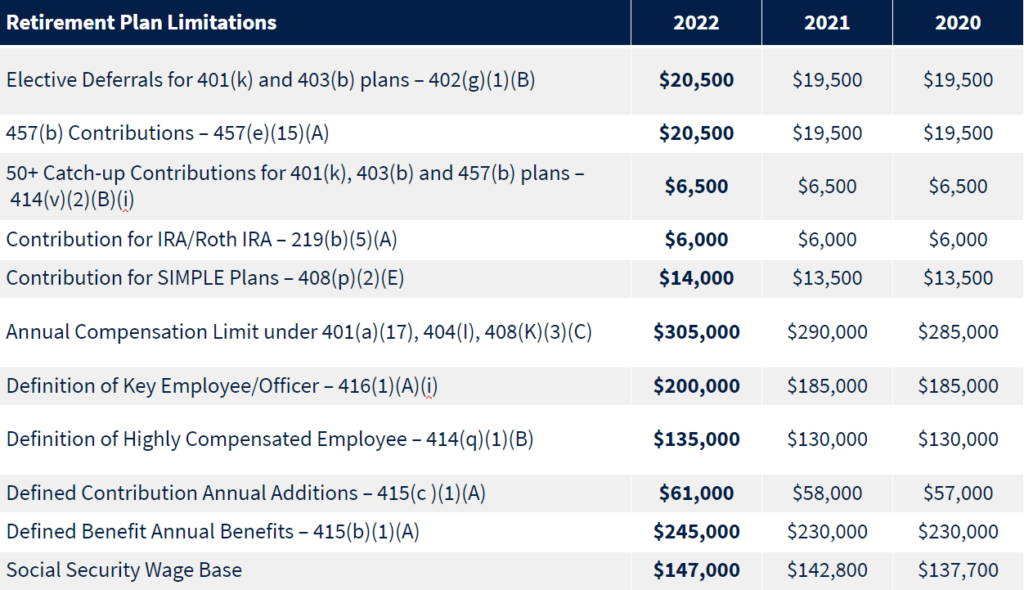

On November 4, 2021, the Internal Revenue Service (IRS) announced the 2022 annual dollar limitations for tax-qualified retirement plans (Notice 2021-61). Changes to the limits are based upon the Social Security cost-of-living increases. The adjustments, which go into effect on January 1, 2022, influence certain contributions and benefits, a handful of which haven’t been adjusted in a few years. As such, plan sponsors and participants should thoroughly review the changes and implications. We’ve outlined the most notable limits set forth in the table below.

Key Recommendations for Plan Sponsors

- Communicate limitation changes to plan participants.

- Review payroll processes to ensure that limitations are properly updated within payroll so that employees who wish to max out their contributions for a plan year are given the opportunity to do so at the higher limits.

- Ensure that there are proper controls to allow employees who reach age 50 during a plan year to elect to defer additional catch-up contributions if they so choose.

Employee benefit plans and their rules can be complex and confusing for both employers and employees. Having a trusted partner that you can go to for clarity and quick answers is vital to ensuring your benefit plans are advantageous for all parties involved. If you have any questions about any of these adjustments, please contact our Audit team.