Authored By Angelo Romano, CFP® | Senior Financial Advisor, SC&H Financial Advisors, Inc.

Preparing for the cost of your child’s or loved one’s education requires careful planning and commitment. With the cost of college steadily increasing by nearly 12% year over year between 2010 and 2020, many families are turning to 529 college savings plans as a solution. A 529 plan is a state-sponsored, tax-advantaged investment account designed to fund a child’s or beneficiary’s education. We’re taking a look at the compelling benefits of these plans and what sets them apart from other college savings vehicles.

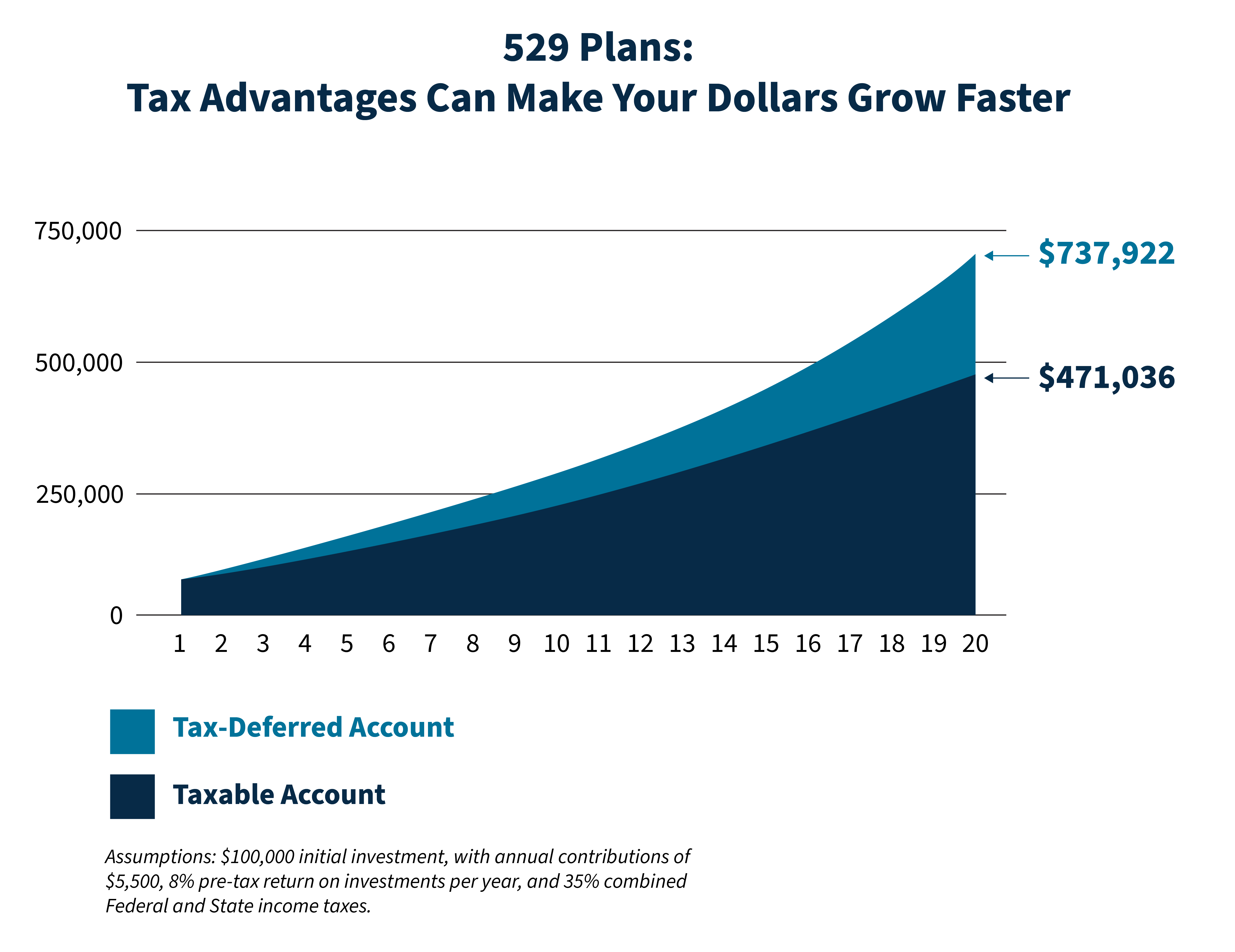

1. The money you invest into the account grows tax-deferred.

This means your money compounds faster because you don’t have to pay taxes on current investment income or capital gains. Over time, this tax-deferred growth can add up quickly.

2. Withdrawn funds used for qualifying educational expenses are tax-free.

Qualifying expenses cover a wide variety of items associated with your child’s education, including books, computers, room and board, and more. As of 2019, funds can also be used for student loan repayments up to $10,000. Additionally, if your child receives a scholarship, you can withdraw the equivalent value of the scholarship from your 529 plan tax-free.

3. Funds can be used for a variety of educational institutions and K-12 programs.

This includes most public and private colleges and universities, graduate programs, and some technical and vocational schools. Up to $10,000 per year can be used to fund tuition at eligible K-12 public, private, or religious schools. You can determine if an institution is eligible by searching its school code.

4. 529 plans have a minimal impact on financial aid.

Because the account is typically in a parent’s name rather than the child’s, the funds have less of an impact on financial aid eligibility and FAFSA treats them more favorably compared to other education savings programs. Only 5.64% of a parent-owned 529 plan can be counted towards financial aid, versus up to 20% of a student-owned account.

5. You can open a 529 plan in any state—and many offer additional tax benefits.

You don’t have to select the plan of the state you live in, although most offer residents a tax deduction for doing so. Nearly every state offers a 529 plan (or multiple plans) with different features, so it’s important to consider what options fit your needs. And should your needs change, you can change your plan to another state. A financial advisor can help you compare plans to select the plan that’s best for your family.

Are you a Maryland resident? The Maryland state-sponsored 529 plan offers a couple of different benefits, including:

- Tax deductions: Maryland residents that contribute to a Maryland 529 Plan are eligible to receive a tax deduction of up to $2,500 per beneficiary per year (or up to $5,000 for a married couple). For example, if a married couple has 3 children and contributes $5,000 to each child’s plan, they can claim a $15,000 tax deduction on their Maryland return. Contributions that exceed $2,500 (or $5,000 if married) can be carried forward indefinitely and used as a deduction in future years.

- Matching contributions: The Maryland Save4College State Contribution Program offers a matching contribution program equal to $250 or $500 annually for eligible lower- and middle-income families that live in Maryland. However, this program does have stringent eligibility requirements and stipulations—we recommend consulting a tax professional to determine if it’s right for you.

6. Account owners have flexible investment options that can be tailored to a target date.

You can choose the underlying investments in the plan, like target date funds or mutual funds, based on when your child or beneficiary will begin withdrawals. For example, if you know your child is starting their first year of college in 2030, you could open a 2030 enrollment-based portfolio fund as your underlying investment option. These funds are designed to adjust the portfolio holdings based on the time horizon until the tuition payment is needed. Alternatively, you could manage the asset allocation yourself using a combination of investment options within the plan.

[sch_cta_box title=”How Much Do You Need To Save For Your loved One’s Educational Future?” button_label=”Get Started” button_url=”https://www.schgroup.com/services/wealth/contact-us/” bg_image=”/wp-content/uploads/2019/05/Primary-Vertical-e1614887994454.jpg”]If the answer is ‘I don’t know,’ don’t worry – we can help. We’ll build you a personalized roadmap to meet your goals.[/sch_cta_box]

7. Beneficiaries can be transferred.

Unlike other types of education savings accounts, the assets never leave the account owner’s social security number. If the designated beneficiary does not need or use the funds—for example, if your child doesn’t go to college—the account owner can change the beneficiary to a relative up to first cousins, or name themselves as beneficiaries and use the funds for their own continuing education.

It’s important to note that you can only use 529 funds to pay for one child’s education at a time. If your children are close in age or have overlapping educational expenses, it may be best to open an account for each child.

8. 529 plans have low minimum contributions and no limit on maximum annual contributions.

No matter what your financial situation looks like, you can benefit from a 529 plan’s tax advantages. It’s even possible to begin utilizing a 529 plan before your child is born. And without annual contribution limits, families can invest as much as they want, when they want.

529 plans do have lifetime contribution limits, but they are typically very high and only apply to your contributions. For example, if the aggregate limit of your 529 plan is $500,000 and you have contributed $500,000 in total over the account lifespan, your money can compound and grow for as long as you keep the account open even though you can no longer contribute funds.

9. Contributions can be used to reduce your taxable estate.

Contributions to a 529 plan are considered monetary gifts to a child. Therefore, if you give less than the annual exclusion limit ($17,000 for individuals or $34,000 for married couples filing jointly), there is no need to file a gift tax return.

Additionally, 529 plans offer the option to spread out a lump-sum contribution over five years to qualify for the gift tax exclusion. This means you can make a gift of up to $85,000 in 2023 ($170,000 for married couples) and average it out over five years to avoid the gift tax. This benefit, known as superfunding, is specific to 529 plans.

10. Unused funds can be rolled into the beneficiary’s Roth IRA.

The Secure Act 2.0 of 2022 enabled account owners to roll 529 funds over to a Roth IRA without penalty. The lifetime rollover limit is $35,000, but the contributions are subject to annual IRA limits and the account must have been open for more than 15 years.

How Do I Select the 529 Plan that’s Right for My Family?

Start by researching the different 529 plans available in your state, as well as any out-of-state plans that may offer attractive benefits. Look for information on investment options, fees, tax advantages, contribution limits, and any other features that may be important to you.

Next, consider your family’s investment goals, time horizon, and current financial situation to ensure the plan you select aligns with your financial objectives now and in the long run. Compare the features of the 529 plans you researched to identify the most suitable options.

If you are uncertain about the best course of action, a financial advisor can provide professional guidance to ensure you set your child or loved one up for financial and educational success. They will work closely with you to provide:

- A customized college savings strategy that fits into your overall goals and financial situation, including how much you need to save and how much you should contribute.

- Personalized advice and guidance to navigate the complexities of 529 plans, select the plan that’s best for your family, and recommend an asset allocation strategy to fit your goals.

- Tax planning expertise to ensure that you realize the full tax benefits of a 529 plan. Tax rules can be complex, and a financial advisor can assist you in optimizing your contributions and withdrawals to minimize tax implications.

- Investment management and monitoring to ensure you’re staying on track. An advisor can modify and rebalance your funds over time to adapt to your needs and account for factors such as time horizons and risk tolerance.

With the cost of education rising, an experienced professional can help you make well-informed and confident financial decisions. The SC&H Financial Advisors team offers personalized, tax-focused financial planning to help guide you through this important and often complex process. Contact our team today and begin designing your personalized roadmap to ensure a successful educational future for your child or loved one.