One of the biggest lags on a cannabis business’s growth is the impact of 280E – a section of the tax code that reads:

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.

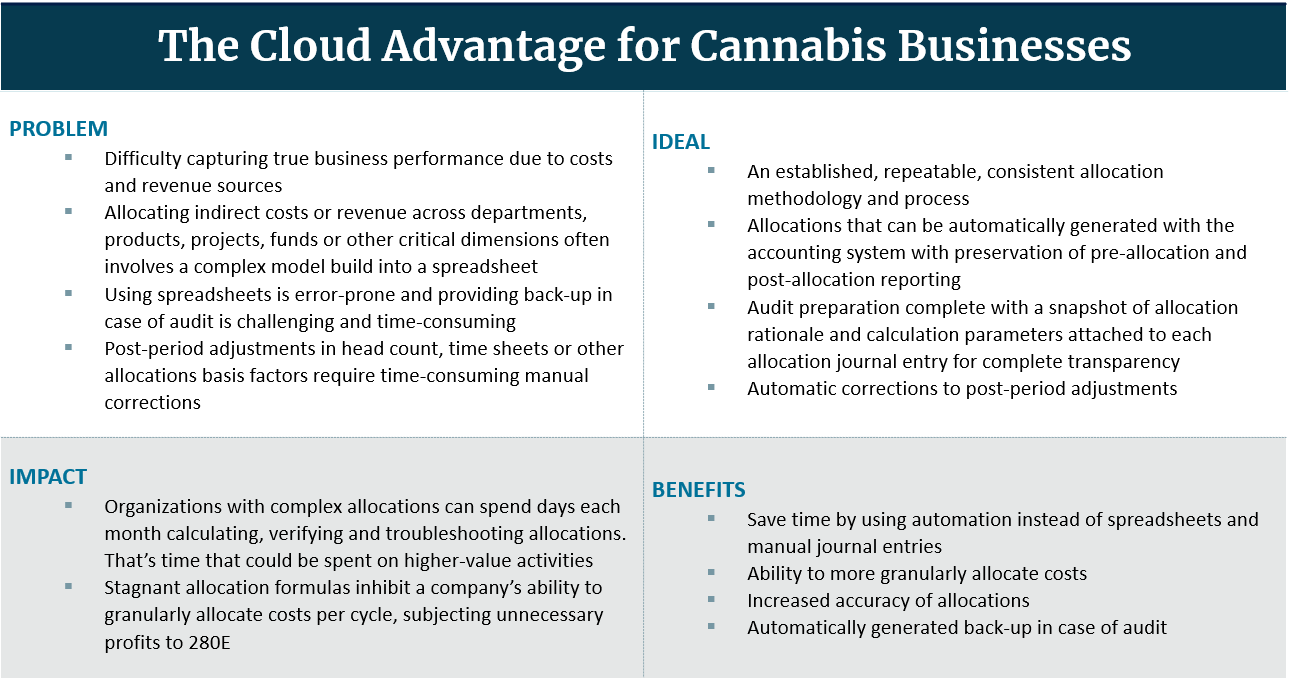

In a nutshell, Section 280E denies a cannabis business the ability to deduct its business expenses in computing its Federal income tax liability. And what’s more, this can eat into profitability margins and cash flow, and mask your business’s true performance metrics.

While this may sound like a drastic, no-way-out situation, it’s not. There is a solution for cannabis businesses to mitigate the impact of 280E and redirect cash into the company for research and development, hiring, expanding capacity and driving growth.

How is this done? The name of the game is pushing expenses into Cost of Goods Sold (COGS). The more you can put into COGS the better, but you need to be able to back up these allocations and defend your positions to the IRS.

Stagnant allocation formulas inhibit a company’s ability to granularly allocate costs per cycle, subjecting unnecessary profits to 280E. The more granular you can make your cost allocations the better. This is where Sage Intacct can help your cannabis business. Intacct will assist you in getting well beyond basic cost allocations and automating the process by which you track these costs. Here is where you can make these cost allocation decisions:

- Administration/overhead – rent, utilities, etc.

- Payroll – matching salary and benefits to COGS, products (either direct or indirectly)

- Capital Investments – spread expenses over time and COGS categories

Organizations with complex allocations can spend days each month calculating, verifying and troubleshooting allocations. But with Sage Intacct’s process automation, your organization will be a step ahead when it comes to mitigating the impact of 280E and saving time for your business. There are several key reasons why automation is the right move for you:

- It’s cleaner – manual processes carry an increased risk for error

- Saves time that can be spent on higher-value activities

- Automatically generates allocations

- Helps to document and execute an established, repeatable, consistent allocation methodology and process

- Less reliance on manual labor along with other employee related costs that may not be deductible

By leveraging the power of Sage Intacct’s automation capabilities to manage your expense allocations to mitigate 280E, you’ll have the back-up documentation you need for the IRS, improve cash flow and enhance visibility into your business’s true performance.

[sch_full_width_image] [/sch_full_width_image]

[/sch_full_width_image]

Please contact SC&H Group’s Accounting Solutions team if you find yourself needing help in growing your cannabis business or have any questions about leveraging a cloud ERP system like Sage Intacct for process automation.