In today’s Strategic Whiteboard Series, SC&H’s Kevin Hebbel provides practical guidance for an organization that is considering implementing a corporate consolidations system and best practices for those who have already made the transition, but are looking to get more out of their corporate consolidations system.

Want to Speak Live with Kevin?

- Phone: 410-988-1350

- Email: khebbel@schgroup.com

Video Transcription

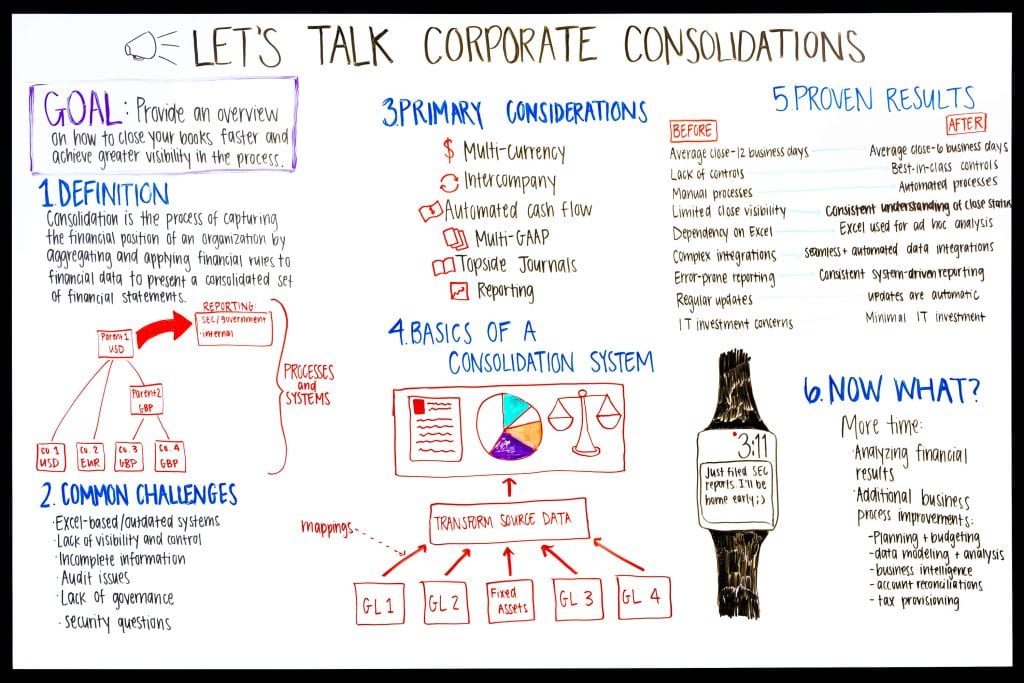

Hi, my name is Kevin Hebbel, and today we are going to talk about corporate consolidations. The goal for today’s session is to talk about how you can shorten your close cycle, and provide you an overview of the corporate consolidation process end-to-end.

Defining Corporate Consolidation

Consolidation is the process of capturing the financial position of an organization by aggregating and applying financial rules to financial data to present a consolidated set of financial statements.

Any large company has to do this. It’s common practice, especially when you’re dealing with a lot of subsidiaries or a lot of companies that are rolling together to produce financial statements. We’ll walk through that process end to end today.

The Consolidation Process

For starters, this image here walks through what that could look like for an international organization. So you may have multiple entities—company one, company two, company three, company four. They may have different currencies. So you could have a USD entity, a European entity, and a British entity that are essentially rolling together into parents and ultimately up to that top consolidated parent. That set of transactions creates a lot of challenges in the financial close process. So we’ll walk through some of those challenges, and ultimately the end goal, which is to get to the SEC or your internal and external reporting in a clean and unified fashion.

Common Challenges

A lot of companies are still using Excel. They don’t have an automated process or a system that really rolls you from that source information up through to the financial statements, and Excel-based processes are typically error prone—a lot of manual input, a lot of people in spreadsheets that are manipulating data and it creates a lot of uncertainty in the financial statements. The process usually has a lack of visibility and control.

Because of the manual touch points, a lot of hands in the various components of the financials, there is a lack of control and ultimately what that leads to at the end of the day is audit issues. A lot of our clients that we work with, really before we put financial systems in place, they’re in a position where they’ve had deficiencies in their audit and they need to improve their process end to end. And that’s ultimately we’re going to talk about as we work through this whiteboard today.

Primary Considerations & Suitability

When you look at the landscape of whether or not Excel, or a simplified process is good for you, or if you need something more complex—you need to consider whether or not you do have multiple currencies, because along with that you get things like CTA calculations, and FX, and when you’re producing your cash flow statement it’s a big challenge to do that with many entities in multiple currencies without a system in place to do that to support the consolidation process. If you have a lot of intercompany transactions where you have businesses within your portfolio, or within your company that are interacting with each other, you can use a consolidation system to really automate that process and get to a good place where you don’t need to do that piece manually. The cash flow process is one I brought this up earlier, but it comes up frequently where companies cannot properly produce the CTA or the FX fluctuations that they need to in their cash flow statement, without a system that can do that.

Multi-GAAP

Many companies that we work with aren’t just reporting in US GAAP. They may also have IFRS reporting requirements or statutory reporting requirements. A good financial system gives you the ability to look at your data in many ways, so you can look at it in any of those by toggling a button on a financial statement, in a report, to view the data in different ways. Another challenge that we often see that leads to this consideration would be the need for topside journals. Are you layering in adjustments that are more the corporate adjustment variety, something that happens with your core financial and accounting team, and if you are the system can control that, it can control the security around that component of making adjustments to your financial statements.

Reporting

And finally the last primary consideration is reporting. Most companies that we work with they have many different reporting needs. They have the needs of the insiders in the organization, management reporting needs, they also have the needs for the external users of the financials. Whether that’s the SEC or other external sources they need to report to, the consolidation system really gives you the opportunity to report every way that you would need to systematically.

The Basics of a Consolidation System

So, let’s talk about the basics of a consolidation system. We talked about a lot of the defined consolidations, we talked about a number of the common challenges, and also some of the primary considerations. Now, if you really get into the basics of a consolidation what does a consolidation system do? If you think about a scenario like this one where you’re a parent company, you have many subsidiaries that you own, a consolidation gives you the ability to take that data in from source systems—oftentimes from multiple GLs—and take that data and bring it into the system in a unified fashion. So usually there is the GL component, the local ledger component, that data gets brought in through a transformational process—usually an ETL tool—and that ETL tool combines the data, puts it on a single chart of accounts, and ultimately allows you to view all of the assets, liabilities, the equities, the debits and credits, that full process comes together into your consolidation system and your consolidation system is really where the magic happens. So that’s where your consolidation adjustments get layered, and where if you have any minority interest or you have companies that are partially owned, you can automate those transactions to make the journal entries post automatically. You can layer in your journal adjustments, your security, that’s all going to be handled within the consolidation system. It’s a unified place for you to do all of the complex consolidation processes that you need to do during your close cycle.

Proven Results

When you do go through this process of implementing a consolidation system, there is a lot of benefits. Our clients have yielded tons of benefits from this process. The #1 thing to focus on is time savings. Most of our clients usually save between 30-40% on their close process end-to-end when they go through and do this. We’ve had a client that moved their close process from 12 business days down to six just by putting a system in place to support all the manual processes that they were completing previously.

Control

Other benefits, control is a really big one, especially in accounting. You need to have an environment where you understand the data as it flows from source system to your reports—a consolidation system is going to give you that control.

Automated Processes

Going from manual processes—hands on keyboard—to processes that are more automated is another key benefit that our clients realize as they go through these transformations.

Minimizing Reliance on Excel

We talked a lot about Excel, dependency on Excel, getting away from that and getting more into where you’re really just using Excel to retrieve data or to report, and not to actually collect the core data and the financial statements is another key benefit of a consolidation process.

Moving to the Cloud

And then finally, today, what you’re seeing is a lot of move to the cloud so less involvement with IT, more control in the accounting and finance organizations, and the consolidation systems that are out there today they all provide that benefit—you can use the cloud, you can implement quickly, and you can get to a place where you have a lot of control over your financial processes end-to-end.

Now What?

Finally, you go through and you take a large step and you move forward and you decide that you want to put this consolidation system in place. You yield the benefits. What does that ultimately get you? It gets you more time to spend analyzing data, time to spend on more pressing financial needs, on moving the organization forward, and not on just combining your data and everything that comes along with the manual processes that you had in place before.

And that gives you the opportunity to consider other process improvements like planning and forecasting, data modeling, business intelligence (BI), tax provisioning—you can take other components of the business and consider moving those into a more systematic approach that’s going to be beneficial for your business overall.

So that’s all I have for you today. I wanted to walk through the consolidation process end-to-end. If you have any questions, feel free to reach out to me via email address or phone (410-988-1350). Thank you!