Sage Intacct Cloud Software

Transform Core Financial Activities

Implement scalable, multi-dimensional, and automated accounting functionality that provides better visibility into your finances and operations. From AP/AR processing and multi-entity consolidations to contract revenue management and an intuitive general ledger, Sage Intacct offers a sophisticated cloud accounting solution that adapts to your evolving business needs so you can reap the benefits:

Increase Employee Productivity

Shorten Financial Cycles

Improve Financial Controls

Create Better Audit Trails

Deploy Transparent Financial Dashboards

Access Accurate Reporting and Analytics

Streamline Business Processes

Make Confident Business Decisions

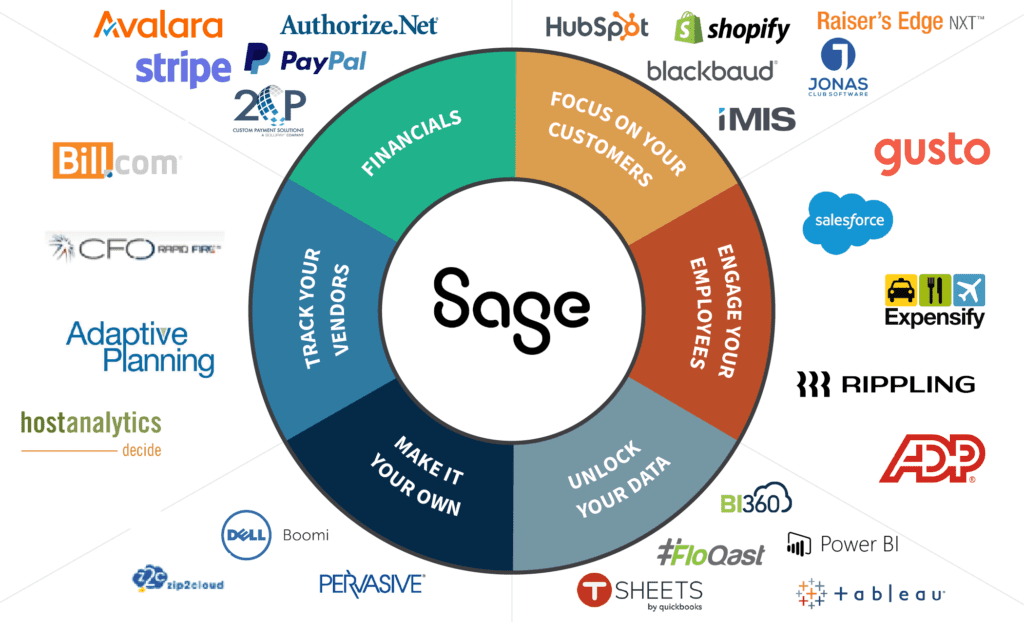

Gain Flexible, Innovative Cloud Integrations

Ditch manual spreadsheets, outdated accounting practices, and entry-level systems like QuickBooks and Great Plains. Through Intacct’s open API, you can access an extensive marketplace to easily integrate true cloud technologies and expand core capabilities. Flexibility for the long term is built-in without the need for back-office IT. This means never having to worry about software updates, ransomware attacks, or unreliable servers. Choose dependable modules and dashboards that meet your requirements and configure the system to satisfy your internal and external demands.

Ready to See How Intacct Can Propel Business Growth?

Schedule a 30-minute 1:1 demo to learn how Sage Intacct can help your organization increase financial accuracy, visibility, flexibility, and speed.

BOOK YOUR FREE DEMOCustomize a System that Meets Your Needs

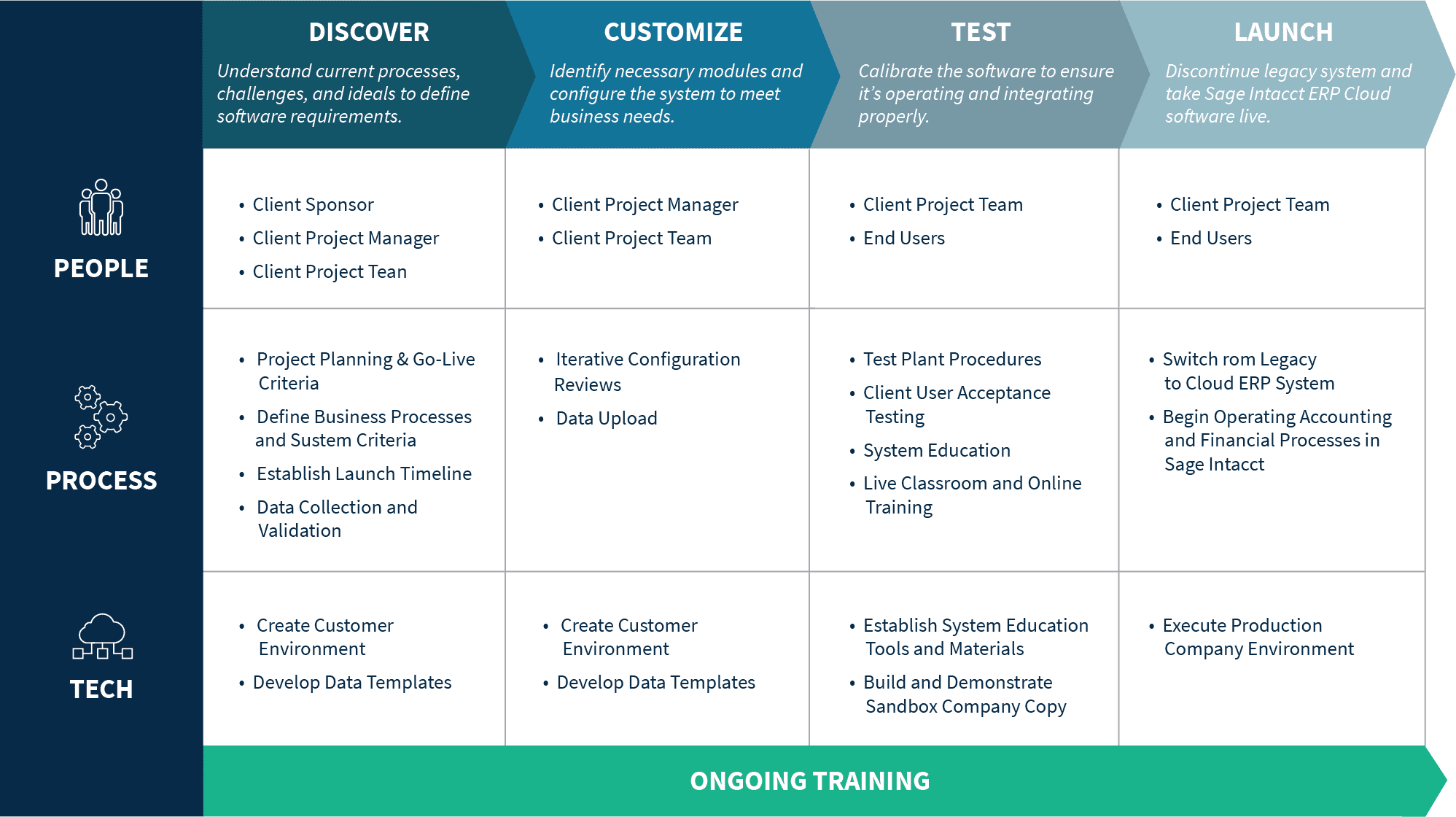

Get a completely customized end-to-end system buildout guaranteed to help your accounting and finance team increase efficiency and accelerate success. As a certified Sage Intacct Partner, we work with your team to identify the necessary modules and integrations, implement them over a defined timeframe, and provide comprehensive training and support. With technical knowledge and hands-on proficiency, SC&H is your one-stop-shop for function, form, user experience, flexibility, and ongoing advisory. Irrespective of business size or budget, we have a model that will meet you where you are and scale as you grow.

Resolve Your Intacct Accounting Challenges

Get the most out of your Sage Intacct ERP regardless of present roadblocks. Whether or not we implemented your current system, we can help ensure it simplifies and enhances your daily accounting practices. You’ve made the investment, we’ll make it work for you. Common challenges we help resolve include:

Maximizing the ROI of your current system

Upgrading an existing implementation

Correcting an implementation gone wrong

Adding integrations to meet evolving needs

Providing critical or lacking training and support

Get Reliable Accounting Advisory and Support

With both technical design experts and experienced CPAs, you get the best of both worlds rarely found in our competitive space. Our accounting professionals have not only successfully implemented Sage Intacct for more than 75 companies but also possess practical and applied software experience from years of routine use. This means the services and solutions we can offer your business during implementation also extend far beyond it, too—from outsourced accounting to outsourced CFO advisory and everything in between. Whether you need regular help now, interim help on a current or future project, short-term help to cover personnel vacations or gaps, or have any other specific needs, lean on our team for the support you need when you need it.

MEET YOUR TRUSTED ADVISORS