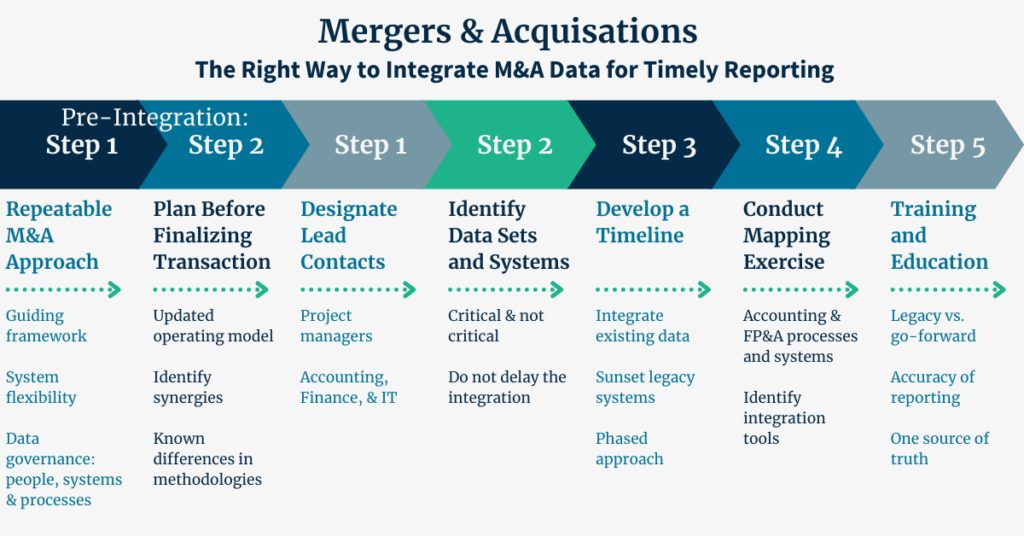

Going through a Merger and Acquisition can be stressful for any organization, but with the right framework in place, your organization can create a repeatable process that has flexible systems, creates data governance, and compiles data in one place for easy data integration. Watch this Strategic Whiteboard Series video to hear Garren LaFond discusses the 7 steps to integrating M&A data and the importance each step has in gaining more accurate integration capabilities.

Want to speak live with Garren LaFond?

- Phone: 703-852-1178

- Email: glafond@schgroup.com

Click on the image above to open a high-resolution version in a new tab

Transcript

Hi, my name is Garren LaFond with SC&H Group. I’m a Senior Manager in our Business Performance Management practice and I specialize in helping my clients with finance transformation. Today, I’m here to talk to you about M&A, some tips and tricks, and a process to get you through an M&A integration.

Repeatable M&A Approach

Hopping right into it, I have preintegration step number one here. This is going to be focusing on a repeatable M&A approach. With that approach, it’s going to focus on creating a framework that you can use for all M&A transactions throughout the lifecycle of the company to make sure they’re all approached the same way. Everyone who is involved knows what their role was as you’re going into a transaction. Part of that is having flexible systems that can accommodate an M&A change, not black box systems that are stagnant and not flexible. In addition to that, you’ll be focusing on data governance across your people, processes, and systems to make sure that everyone again knows what they should be doing during an M&A transaction and how the processes in the organization flow to best address the coming change.

Plan Before Finalizing Transaction

Moving along, we have integration step number two here, which is planning before the integration and before the transaction is closed. What needs to happen here is the operating model needs to be evaluated to see if it needs to change and and how it might need to change across the old organization to the new organization. In addition to the operating model, you’ll want to look for any synergies or any known differences in methodologies across the acquiring and acquired company. One of those differences could be a difference between a cost line item reporting, so one company might trade a cost different than another one. You’re going to want to make sure you’re ahead of those things when you’re coming up with your project plan.

Designate Lead Contacts

Now hopping into the integration steps overall. We have our first step here, which is designate lead contacts. That would be project managers, accounting, finance, and IT personnel across both organizations to ensure that there’s collaboration and all key points from both companies are included. In addition to that, you want to make sure that the team works on a frequent collaborative basis with regular check ins to make sure the project is staying on track.

Identify Data Sets and Systems

Next we have identify data sets and systems. Here you want to identify your critical versus not critical systems, and you’re going to want to make sure that you don’t delay the integration. You to make sure that you’re getting your critical systems and data integrated, like your accounting data, your financial planning & analysis data integrated in a timely manner, and that you’re saving any other non-critical systems and data sets for later.

Develop a Timeline

As we pivot to the next step that we have here, we have developing a timeline. We’re going to want this timeline to include integrating data and sunsetting legacy systems. In that you’re going to want to do a phased approach where your take your most critical data first and move along to your least critical data sets within the timeline. The most important piece would not be doing all of the integration at one time and phasing it out so you’re not doing a “Big Bang” approach. No one likes a “Big Bang” approach. They tend to never work, and it’s only good for TV.

Conduct a Mapping Exercise

Moving along to the next one, conducting a mapping exercise. You’re going to want to make sure that you are integrating your accounting and finance and FP&A processes to ensure that you’re able to identify your integration tools and come up with any of the mapping differences between those cost line items or be able to realize any synergies we were talking about earlier.

Training and Education

The final piece after the mapping exercise and integration and even during, you want to train and educate your people on go forward methodologies versus legacy methodologies, so everyone understands where the organization is headed. As a result, you’ll have more accurate reporting and everyone will know that this system and this organization has one source of the truth where everyone can go to get the same information and that your data quality is not going to be compromised. That’s all I have today. Thank you for listening to the video. My contact information is at the bottom of the video and also on the website.