Authored by Judy Brown, MBA, CPA, CFP® | Principal, SC&H Financial Advisors, Inc.

Now is a great time to review your 2022 retirement plan contributions and discuss the impacts of the 2023 contribution limit changes with your financial advisor. Leveraging the increased retirement plan contribution limits can help keep you on track for your financial and tax goals.

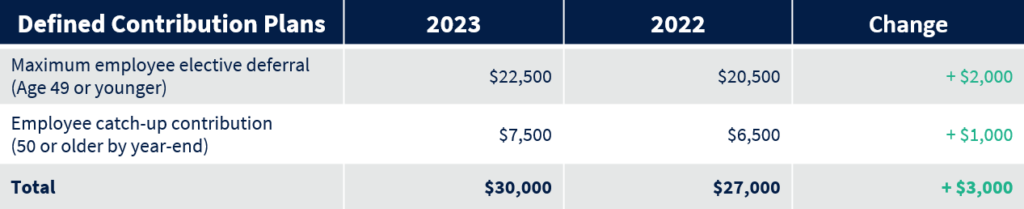

401(k), 403(b), most 457 plans*, and the Thrift Savings Plan (TSP)

*Special considerations for some 457 plans.

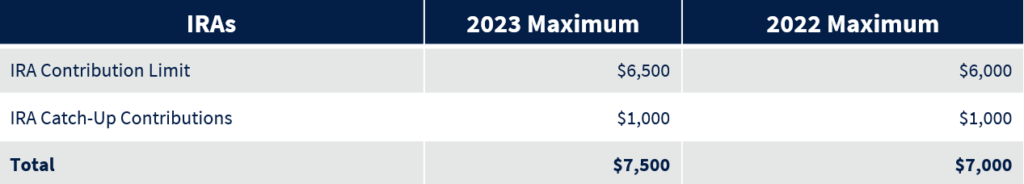

Individual Retirement Accounts (IRA)*

Traditional IRAs are pre-tax contributions, your money grows tax-deferred, and withdrawals are taxed as ordinary income after age 59 ½.

Roth IRAs are after-tax contributions, your money grows tax-free and you can usually make tax and penalty free withdrawals after 59 ½.

*Note that there are income phase-out thresholds for the Traditional and Roth IRA which have also increased. Our advisors and tax professionals can help determine if you are eligible.

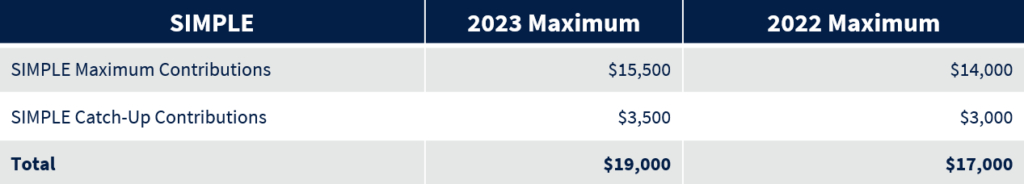

Savings Incentive Match Plan for Employees (SIMPLE) IRA

A SIMPLE IRA retirement plan is for self-employee individuals, small business owners, or any business with less than 100 employees and no other retirement plan. Contributions can be made by the employee, but the employer is required to make either matching or nonelective contributions.

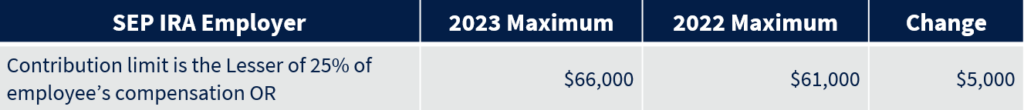

Simplified Employee Pension (SEP) Plan

A SEP-IRA retirement plan is for self-employed individuals and small business owners. Contributions are made by the employer only, not the employee.

To review all of the 2023 IRS changes, please visit: https://www.irs.gov/retirement-plans

SECURE Act 2.0

On December 23, 2022, the U.S. House of Representatives passed the long-awaited retirement bill known as Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0. The SECURE Act 2.0 brought a wide range of changes to retirement planning. Although many of the changes will begin in 2024, you can begin planning this year. Please stay tuned for more information about the SECURE Act 2.0.

If you have any questions about the IRS announcement or the SECURE Act 2.0, the team is here to help.

[sch_cta_box title=”Gain Comprehensive, Customizable, Tax-Focused Financial Solutions for You and Your Family.” button_label=”Download Our Informational Booklet” button_url=”https://www.schgroup.com/wp-content/uploads/2023/05/SCH-FInancial-Adivsors-Booklet-05-2023.pdf?utm_campaign=WM%20%7C%20Client%20Experience&utm_source=WM%20Resources&utm_medium=New%20Wealth%20Management%20Booklet” bg_image=”/wp-content/uploads/2019/05/Primary-Vertical-e1614887994454.jpg”][/sch_cta_box]

Advisory Services offered through SC&H Financial Advisors, Inc., an investment adviser registered with the U.S. Securities and Exchange Commission. SC&H also offers advisory services through the doing business as name of SC&H Core. SC&H Financial Advisors, Inc. is a wholly owned subsidiary of SC&H Group, Inc.

The information presented is the opinion of SC&H Financial Advisors, Inc. and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance.